July 13 is a date that I like to reflect on my progress towards my goals because it was the first day that I got back into the gym in 2015 after some extended time off during my senior year of college. It’s not only a time for me to reflect on my fitness goals, but it’s also a time for me to reflect on my financial goals for the year and determine if there’s anything that I need to change going forward to reach them.

Evidence-Based Fitness

I’m going to start with my fitness goals because I wouldn’t be thinking of writing this post today without them.

I’ve gone through the gamut of the trial and error process of fitness – starting out with “bro splits”, moving through fad diets and supplements, and finally finding the evidence-based fitness community. This community simply utilizes the latest research and evidence to find the most optimal approaches, as well as the most sustainable solutions, to fitness and diet. This includes identifying ways to easily incorporate fitness and diet into the busy lifestyles and work schedules that many of us have.

Those who I have found to provide the best and most relevant information for me, and who I would recommend following, are Dr. Eric Helms as well as the rest of the 3DMJ team, Dr. Layne Norton (he can get a little “passionate” and sometimes vulgar for some), Jeff Nippard (amazing and extremely informative YouTube videos), and Kalim Menzel (he can’t spell, but his Instagram stories and posts provide a ton of valuable information including breaking down studies and providing applicable lifestyle strategies).

Two great infographics that can help you make diet and training much more simple are Eric Helms’ Muscle & Strength Pyramids. They’re laid out like the old Food Guide Pyramid with the most important aspects at the bottom and working up to the least important things to focus on at the top.

The firm that I work for, Market Street, utilizes an evidence-based approach to investing using the latest information from DFA and Vangaurd, and I only see it fit to do the same in my health endeavors.

Focus On The Long-Term

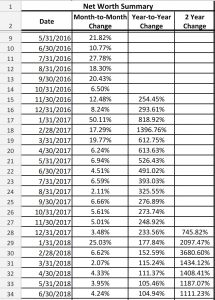

I’m not nearly as lean as I was this time last year, but that’s on purpose. Last year, I wanted to get into the best shape that I could just to see what I would look like. I had never seen my abs before and that’s kind of where I wanted to see if I could get to. Goal accomplished. However, that was a short-term goal and I wouldn’t have been able to sustain that physique and still enjoy all of the things that I want to consume as well as stay in a good mental state.

Now it’s time to focus on my long-term goals. Where I’m at now is a much better place for me and is much more supportive of my long-term goals of gaining muscle and getting stronger. Over the past year, I’ve gained some muscle and learned a ton more about fitness and nutrition, including more sustainable practices for each.

7/13/2017: 159.8 lbs

7/11/2018: 175.0 lbs

The most objective view that I can take is that my back continues to progress and get bigger, my front takes much longer to develop and needs a lot of work, and my legs have probably seen the best transformation over the past year but I don’t have anywhere to get good progress pictures of them besides at the gym.

I don’t wanna be that guy at the gym hiking up his shorts and taking pictures in the mirror.

I’ve used Avatar Nutrition, an online macro coach based on flexible dieting with access to Registered Dietitians available via email for any questions that you have, since November 2016. Avatar is pretty cheap at $9.99 per month but provides so much more value to me than that, especially when compared to most other coaches. That’s a great investment in my health.

There is no fad diet, no miracle product, and no workout program that is going to make you reach your goals. I mentioned the 3DMJ team above. Those 3 D’s stand for dedication, desire, and discipline. Those are the miracle products that are going to help you reach your goals, whether that be in fitness or finance.

You can see a glimpse of my progress from 2012 through 2017 here.

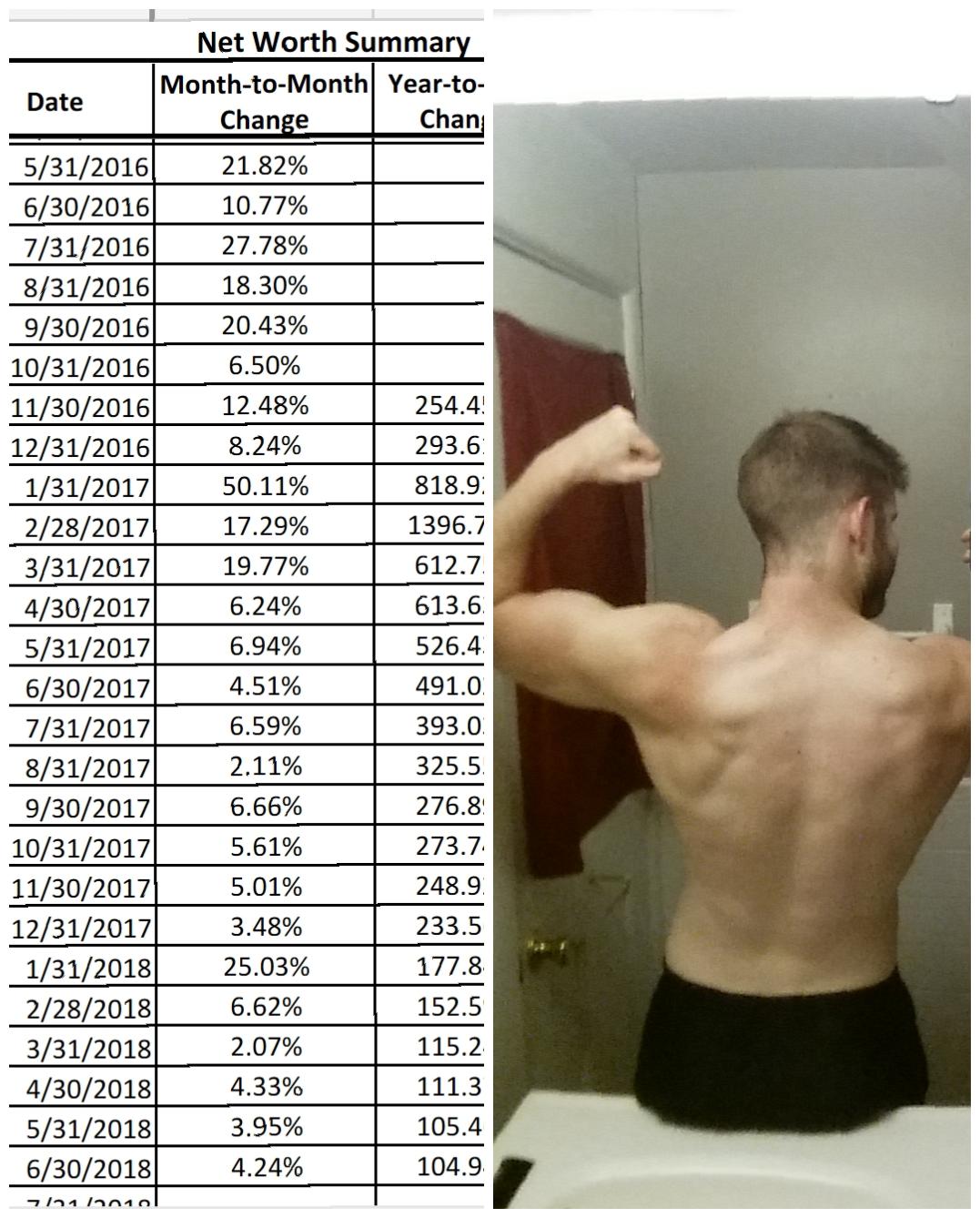

Finance

As you can see, I’ve increased my net worth by 46% year-to-date, 105% from this time last year, and 1111% from this time two years ago. However, this rate of progression is probably only realistic for those who either have just recently graduated and are starting their careers or those who have not yet begun tracking their net worth and being proactive about growing it. Those who are well on their way on the path to financial freedom probably won’t see these 1000s of percentage rates of progression. The reason that my percentage net worth increases so rapidly is because I still have a relatively low net worth and a relatively short length of time of tracking.

As you can see, I’ve increased my net worth by 46% year-to-date, 105% from this time last year, and 1111% from this time two years ago. However, this rate of progression is probably only realistic for those who either have just recently graduated and are starting their careers or those who have not yet begun tracking their net worth and being proactive about growing it. Those who are well on their way on the path to financial freedom probably won’t see these 1000s of percentage rates of progression. The reason that my percentage net worth increases so rapidly is because I still have a relatively low net worth and a relatively short length of time of tracking.

I attribute this growth to a combination of living frugally and being intentional with my money, setting and actively pursuing a goal of saving 30% of my gross income, saving my bonus and tax return rather than spending them, and not taking on unnecessary debt.

No one ever said that the road to financial freedom is easy, but you can do some things to make it as easy on yourself as possible. Continuing with the theme from above, Meb Faber has recently created a Personal Finance Pyramid as well as an Investing Pyramid with the most important pieces to focus on at the bottom and progressing towards the things that will have less of an impact at the top.

Personal

Another goal that I set for 2018 was to post helpful financial information and tips that others may not otherwise have access to at least once per week, which is what lead to me starting this blog. So far so good! I’ve since amended that goal to include ensuring that I complete some sort of learning each day (whether that be reading, listening to podcasts, watching webinars, or preferably a combination of each) that I can use to help others. I’m doing pretty well on this goal, so far.

Your Own Goal Check-In

Are you tracking towards reaching the goals that you set for 2018? If not, what can you do to get back on track?