Over the weekend I spoke to a friend who graduated from physical therapy school earlier this year. He didn’t have any help with school expenses and graduated with $160,000 in student loans. To his benefit, he’s pretty frugal and has a good natural sense about money. However, $160,000 is a really big number and it has him worried. He’s been asking himself if he’s going to be able to be okay with that amount of debt and whether the right decision is to pay down the debt as quickly as possible or if he should save for retirement as well.

Young Professionals

What Do You Do?

Last week and this week are full of me “giving back” to the community. Last Thursday, I attended an Indiana State University Financial Planning Advisory Board meeting where we answered students’ questions and had lunch with some of them, this Thursday I will be at Eminence Elementary School for 4th & 5th Grade Career Day where I believe other middle school and high school teachers may be expecting me to speak to their classes as well, and on Friday I will be participating in Student Day with the Financial Planning Association of Greater Indiana. I have a hard time calling these types of things “giving back”, but that’s what others call them so I’ll stick with it.

The 3 Financial Tips Young Professionals Need

4 minute read

Keep The Big 3 In Check

The Big 3 are the 3 biggest expenses that most people have: housing, transportation, and food. Keeping these 3 costs in check will have a much more significant impact on your cash flow than skipping your morning coffee from a shop. Not only will being intentional about keeping these expenses low allow you more flexibility with your cash flow, but it will also allow you to maintain a higher savings rate (the next key we’ll speak about).

A rule of thumb that’s thrown around is that your monthly mortgage payment (including principal, interest, property taxes, and homeowner’s insurance) should be a maximum of 28% of gross income. However, many people fail to recognize this is a maximum. You’re probably already having a third of your income taken for various income taxes when considering FICA, Federal, state, and local taxes. If you’re spending nearly another third on your mortgage payment, then where are you going to get money to save, pay bills, or accomplish your goals?

Stretching your cash flow just to buy the house of your dreams probably isn’t a good idea. Adjusting your mindset and being willing to live in cheaper housing will provide much more financial flexibility in the long run. Once you’ve made a mortgage payment you can’t get it back unless you pay to take out the equity in your home.

Yes, we all want to drive a nice, brand new car, but is it worth sacrificing other goals over? New vehicles are expensive and transportation costs count towards a large part of many people’s cash flow. The point of having a car is to get from point A to point B and a cheaper, but still reliable car, does the exact same job as an expensive one – just not in as much style.

If cars are your thing and you’re willing to make significant sacrifices in other areas of your life to make sure that you’re able to reach your goals, then that’s fine. However, since experiences provide more happiness than things, I prefer to spend part of the money that I would on an expensive car on experiences that I’ll value for much longer and save part of it to help me reach financial independence. Cheap transportation still gets you to where you need to go and provides financial flexibility while doing so.

Cooking at home can be very time consuming, but it can also save a lot of money. The convenience of eating out is relatively expensive compared to buying groceries and cooking at home and can be much more calorically dense. Just consider the amount of meals that you can prepare with the $50 you might spend at a decent restaurant on a date night. Eating out doesn’t need to be cut out of young professionals’ budgets completely, especially if trying new foods and restaurants is something that really makes you happy, but it shouldn’t happen as often as you preparing your own meals. Cutting back on eating out can provide significant savings if it’s something that you do often.

Maintain A High Savings Rate

Starting out with a high savings rate is extremely beneficial to young professionals because of the significant amount of time that we have to invest the money. Additionally, saving a large percentage of your income can help to mitigate too much lifestyle creep and it can provide flexibility in the future when life happens and you’re not able to save as much as you need to.

Maintaining a high savings rate doesn’t mean that you have to save as much as possible or even have a high savings rate every single paycheck, month, or year. There will likely be periods of higher savings and lower savings – what’s important is that your savings rate remains high over time. Most young professionals won’t have pensions available to them and the future of Social Security for younger generations isn’t certain; it’s up to us to be responsible and create successful financial futures for ourselves by saving now.

Develop Good Financial Decision-Making Skills

Keeping The Big 3 in check and maintaining a proper savings rate are great financial habits, but what happens when something pops up that you weren’t necessarily ready for? It could be a financial emergency or a financial opportunity, but either way you need to be prepared to make the right decision for any situation. Having goals clearly stated for what you want your money to do for you can help with this.

How will you react when your car breaks down and can’t be fixed? Will you buy a brand new one that you’ll need to move on from in a few years because it isn’t practical long-term, buy a new car that you know you’ll be able to drive (and enjoy) for the next 10 years, or will you buy a cheaper, used vehicle that still has significant life left in it?

What about if you’re presented with a financial opportunity to help start a business or purchase a home for below market value? It’s important to revisit your goals and see if these decisions fit into them. Even if you’re able to buy it below market value, you probably wouldn’t buy a home if your goal is to find a job in a different city in the next 6 months.

Keeping The Big 3 in check, maintaining a high savings rate, and developing good financial decision making skills can all be invaluable to young professionals in the long run. These skills will not only allow you to develop a solid financial foundation now, but will likely carry with you throughout your life to help you to be financially successful. Money is a tool that we can use wisely to help us reach our goals or something that we can waste away without being intentional with it – I think that making sure it helps us reach our goals is a much better option.

The Millennial Mentality

2 minute read

I just happen to be a Millennial and I really wanted to respond to that comment, but I held my tongue (fingers in this case, I guess) because we all know how messy things can get in Facebook comments.

Well, now I’m going against that original thought. Let me explain to you the Millennial mindset and hopefully help clear up some of your misperceptions. If you’re unaware, it’s generally agreed upon that Millennials are those who were born between the early 1980s and mid- to late 1990s (those who are somewhere between age 22 to 40, as of the time of this writing).

First of all, keep in mind who raised the Millennials (looking at you, Baby Boomers and Generation X) before blasting them on Facebook because you believe we’re a generation of those who feel entitled, have never been properly punished, and who have been given participation trophies our whole lives.

We didn’t raise ourselves.

According to research, Millennials are hard workers (if you trust Harvard Business Review and World Economic Forum) who largely have a great understanding of the world as a whole and what the future looks like. We’re the people who are going to be paying into Social Security just to see it go right back out to pay for benefits for the older generations since the Social Security Trust Fund is projected to become insolvent in 2034, according to the Chief Actuary of the Social Security Administration. What was that you said about entitlement?

We also get to inherit the misfortunes of unprecedented amounts of student debt as well as continuously rising rent and home costs, all while facing stagnating and, in some cases, declining wages. Additionally, only 24% of us demonstrate a basic understanding of personal finance. I guess prior generations didn’t think this would be important to teach us.

According to the J.D. Power report mentioned above, “The average Boomer will hit age 65 with just 3.4 years of current income saved, far short of the 10 years some experts recommend.” Meanwhile, “Nearly two-thirds (61%) of Millennials have at least $25,000 in total retirement savings, and 27% of them have more than $100,000, with an average of 30-35 years before retirement.” No participation trophy to be found here. By the way, a pension to look forward to sure would be nice.

If this is the Millennial mentality that we’re talking about, then I think it’s a great mentality to have.

Please excuse us if we don’t want to follow in your footsteps.

The 35-Year-Old with Almost 3X Salary Saved

3 minute read

Last week, I wrote about all of the backlash that MarketWatch received from its Tweet stating, “By 35, you should have twice your salary saved, according to retirement experts”. That same day, I met with a 35-year-old who has saved 2.7 times his salary – compare that to Fidelity’s suggestion of saving twice your salary by age 35. I had no idea this was going to be the case, but I thought it was an awesome coincidence.

How is this possible?

He does have some things going in his favor including that he doesn’t have a significant other or kids. Regardless, I don’t think that should take away from what he’s been able to accomplish. He doesn’t have a large income, but he intentionally keeps his living expenses low which allows him to live simply and save 60% of his income per month. 60%. That’s awesome. He doesn’t mind living on that amount of money because he would rather have a job that he enjoys, that’s flexible to his needs, and that doesn’t cause him too much stress. He values experiences over “stuff”.

On top of that, he told me that he travels to Europe 3 times per year. But, as you could imagine coming from someone who is able to save so much, he doesn’t spend money on lavish trips. Instead, he spends money on experiencing new cultures and focuses on meeting new people. He told me that he’s going to travel to Portugal this year for $231 (that includes his airfare and stay in a hostel) and that he’ll probably travel to Australia and stay with someone who he met while staying in a hostel on a previous trip.

It pays to be resourceful.

I was inspired. If this doesn’t make you think that you can use your resources (money) more wisely, then I don’t know what will.

There are plenty of legitimate reasons why someone couldn’t save twice their salary by age 35, but I’d argue that there probably are also plenty of areas in which you aren’t willing to cut your spending (or increase your income) to do so.

After speaking with him, I started thinking about ways that I could decrease my spending. Not all of them are exactly realistic at this time, but I was thinking about what would hypothetically be possible for me to do which would allow me to increase my savings to 60% of my income.

The first place for me to look is housing since it is my biggest expense, as it is for most Americans. If I had more roommates, then I could not only decrease my rent, but I could also decrease all other utility bills since they would be split more ways. Secondly, I could decrease my grocery bill as I tend to spend quite a bit at the grocery store. I try to eat a relatively nutritious diet which includes fresh fruits and vegetables as well as a lot of protein to support my efforts in the gym. Nutritious food and protein aren’t cheap. I know I could spend a fraction of my current grocery bill if I didn’t care about my diet and bought the cheapest things possible.

I don’t have a vehicle payment, but if I did this would be the next logical step in the progression. Owning a very expensive vehicle doesn’t really do you any favors when trying to cut your expenses and increase your savings rate. A cheaper, but still reliable, vehicle does the same thing as an expensive one.

A lot of money can be saved by spending less on nondiscretionary expenses as well. These are expenses that aren’t necessary, but that you like to spend on and perhaps make your life a little bit easier. Most of us could save money by cutting back on things like eating out, getting a beer with friends at a local brewery, going out to the bars during the weekend, new clothes, buying things on Amazon (that’s a black hole), subscriptions services, etc. I bet you’d be surprised if you wrote all these things down and added up what you spend on these categories in a month.

I was inspired to take a fresh look at my spending habits after speaking with this person and I hope that you are too. Without even going into a deep analysis I know that thee are many areas where I could cut my spending, and maintain the quality of life that I desire, to help me reach my savings goals and reach financial freedom at an earlier age.

Apparently young people don’t want to hear about saving for retirement

3 minute read

No Title

No Description

Did you receive a large tax refund (or owe a large amount of tax) in 2017?

2 minute read

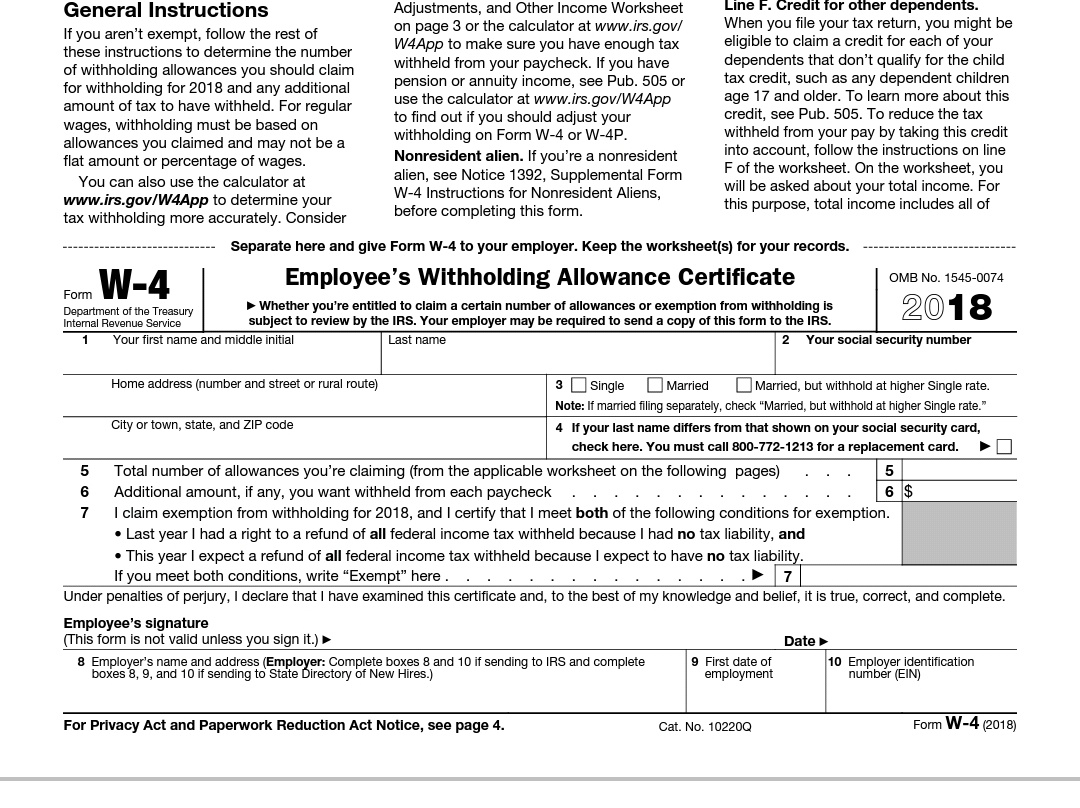

If you received a large tax refund this year, or if you owed a large amount in taxes, one thing that you can do to help get this number closer to 0 is to adjust your Form W-4 Employee’s Withholding Allowance Certificate. This may be especially prudent in 2018 due to changing Federal income tax rates and withholding tables.

Wouldn’t you rather have that money available to you throughout the year rather than have to wait until the beginning of next year to get it back? Wouldn’t you rather know that you’re adequately covering your tax burden throughout the year rather than being hit with a huge payment come filing time?

Most people probably file their W-4 when they’re hired and never revisit it again unless their tax preparer hands them a new form to give to their employer. This form tells your employer how much they should withhold from each of your paychecks to send to the IRS on your behalf to pay your income taxes.

Although certainly not optimal, I can see how there could potentially be an advantage to receiving a small refund if it helps to keep you disciplined with saving. Maybe you know that you would spend that money if you received it throughout the year but if you receive the larger refund at one time you will be more inclined to send it straight to your savings account or use it to pay down debt.

Just because you’re married and have kids doesn’t mean that you should be taking all of those allowances on your W-4. Sometimes this can actually lead to you owing more in taxes at filing time since marking allowances on the form means that your employer will withhold less of your income.

It’s best to consult your CPA or EA when considering adjusting your withholdings. If you received a large refund or still owed a large amount in taxes, then they should be proactive at helping you to adjust your withholdings anyways.

Young Professionals – Think About Your Retirement Savings

< 1 minute read

When I graduated college, one of the first things that I did was start contributing 10% of my income to my Roth 401(k). I set this as my number one priority and structured the rest of my financial goals around it.

Was it easy? No, but I figured it out.

I’d bet that if you ask most young professionals how much they contribute to their retirement accounts that they’d tell you “up to the match”. Typically, but not always, the match is 3%.

Most young professionals don’t have the pension benefits that our parents and grandparents depend on for retirement and changes continue to be made to Social Security laws due to potential future insolvency of the trust fund (absent any further changes).

It’s more of a responsibility for young professionals to save for their retirement now than it ever has been in the past.

Are you confident that saving 3% of your income will get you through a potentially 30-something year retirement?

*Please note that 10% isn’t a magic number, it’s simply where I started at.*

Millennial Money Mistakes

< 1 minute read

The 3 mistakes that the author listed are:

- Spending on status symbols

- Throwing all your extra cash toward student loans

- Avoiding investments altogether

If you’re a millennial, then time is on your side. Make the sacrifices now to create good financial habits and set a solid financial foundation that will reap dividends in the future.

Materialistic things do not provide gold to the soul or proper peace of mind, but you may find that setting yourself up to be financially successful for the rest of your life does.

You might decide that you want to retire some day and you’ll probably want more than a stack of change to retire on.

Creating a Financial Foundation

< 1 minute read

Here’s a checklist:

- You have a budget in place so that I can tell my money where to go rather than being a slave to it

- You have an adequate emergency fund in place

- You have adequate insurance coverages in place

- You’ve written down my monthly savings goals and are working towards them

- You’ve written down my monthly debt paydown goals and are working towards them