At the end of each month on my podcast (Circle City Success), my co-host Jason and I recap the episodes for the month and speak about some of the common themes and things that we learned. Last month, we had a special guest host (and former podcast guest) do the recap with us, which was really fun. As I was thinking about the recap, and the theme that we heard of intentionality, it made me think of a question that people should be asking themselves more often: Are you intentional with your money?

Mindset

The Hardest Part Of Making Financial Progress

I get up at 4 AM three days per week and I don’t use the snooze button. I do have a trick though. I set an alarm 5 minutes before I want to get out of bed and then I actually do get out of bed once my “wake up” alarm goes off. (It’s not cheating.) Most people think I’m crazy for getting up so early and heading to the gym before work and they tell me how hard it is for them to get out of bed in the morning. My response, “The hardest part is making your feet hit the floor.”

Thankful 2019

I’ve got a ton to be thankful for in 2019 from ringing in the new year with some of my best friends and one of my favorite bands to traveling to Austin to getting married, just to name a few things. Those are the obvious things to be thankful for when reflecting on 2019, but there are so many things that most of us probably don’t think about on a day-to-day basis that we should be grateful for as well.

Cars

My uncle, who is the master of finding deals on vehicles and somehow actually making money from selling used cars even after he drives them for a while, sent me an article titled Opinion: The road to riches is this simple: Drive a junky car by Jared Dillian. Obviously, this article resonated with both of us, but I suspect that many wouldn’t even begin to read it simply because of the title.

Looking Rich

Do you think that you look rich? Do you think that the person who drives a brand-new car looks rich? What about the person who lives in the most expensive house in their neighborhood? Just because someone “looks” rich doesn’t mean that they are. In fact, someone who “looks rich” because of the car that they drive, the house that they own, or the vacations that they take is probably actually not wealthy.

Thankful

2 minute read

Yes, I am thankful for my family, my friends, where I live, and my health, among other things, but there are so many other things to be thankful for that I think most of us take for granted most days.

The United States is one of the wealthiest countries in the world with opportunities abound. No, money doesn’t buy happiness (well, not the way most Americans use it), but it can buy security and opportunity and a better life. Most of us who live in America have an infinitely better life than the majority of the world. A lot of our day-to-day worries and complaints are “first world problems” that people elsewhere would find appalling to complain about.

Every day first thing in the morning on my way to work or the gym I try to think about all of the things that I have in my life that many others, if not the majority of people in the world, don’t have. I wake up safe on a nice mattress in an apartment with heat, crystal clear running water, and electricity. I get up and brush my teeth, get dressed and put on quality clothes and shoes, and grab my bag to carry my things with me for the day.

I grab something for breakfast and something to take with me to eat for lunch. I close my door and lock it, making sure that all of the other things that I have in my apartment are safe and secure. I get in a safe vehicle that I don’t have to worry about whether it will run or if it has enough gas to get me to where I need to go. Depending on the day, I either go to the gym or the office that both have clean running water, heat, electricity, and everything else that I need to accomplish my goals.

At work I have access to a nice office, my computer, everything that I need to do my job, and food. At the gym, I have different set of clothes to work out in, a smartphone to listen to music and track my workout, Wi-Fi, headphones, and a full gym to use.

Every single one of these things that I’ve mentioned is something that someone else in the world doesn’t have access to. And I haven’t even scratched the surface. We have so many things to be thankful for and so many things that we take for granted. We complain about things like our phone not working properly or our internet being slow when there are others in the world who don’t have a place to live, water to drink, or food to eat.

Sometimes, for me at least, it’s best to take a step back when I’m about to complain about something and think about how fortunate I am and all of the things that I’m thankful for.

On the day that we’re called to be thankful, I implore you to inquire a bit deeper than you usually do on a normal day and consider all of the things that you have that others don’t. I think it may make you a little more thankful and hopefully less quick to complain about things that don’t really have that much of a negative impact on your life as it may seem in the moment.

Why Wait?

4 minute read

“I can accept failure, everyone fails at something. But I can’t accept not trying.” – Michael Jordan

Push Yourself

2 minute read

Being selected as a Board member is exciting for me because it’s a way for me to give back and help young professionals in my community as well as meet and learn from other highly motivated people. It will also be another challenge for me to help further develop my skills as the Board works to secure sponsorships and develop a calendar of events that attracts young professionals and isn’t just more of the same thing that they could get through other groups.

I see this as pushing myself for many reasons. I’m naturally introverted and would be just fine sitting at home by myself after work. Instead, I’ve been pushing myself to get out and meet new people and have conversations to help develop my skills and my network.

I don’t have to make the extra effort outside of going to work every day, but I want to push myself to be better. I always feel a little anxious while I’m on the way to events like these where there are a lot of people that I don’t know and I’m supposed to randomly start conversations with people (especially since I don’t feel like I’m very good at speaking), but that’s part of me pushing myself as well.

As I’ve written before, I’m always motivated by speaking with and being around those who are passionate and come together as a team to accomplish their goal. I love hearing stories about how people have succeeded (and how they are succeeding) and I know that being a member of YPCI’s Board will grant me many more of these opportunities. I’m also sure that I’ll learn a ton from those I’ll be working with.

I think there are plenty of ways that I can help YPCI with my skillset, although I think I’ll receive more benefit than I’ll be able provide. Not only does attending events such as YPCI’s Happy Hours allow you to make new friends and network, but it also helps you develop many other skills such as public speaking, learning to ask questions and figure out how you could help others, and being able to connect those who may not already know each other but could benefit if they did.

I’m looking forward to seeing what we can accomplish in 2019!

Push yourself and make yourself uncomfortable so that you can grow from it.

My two favorite quotes reflect this mentality.

“Success comes from knowing that you did your best to become the best that you are capable of becoming” – John Wooden

What’s The Value

4 minute read

I work for a firm that charges clients a fee as a percentage of the investable assets that we manage for them (we charge this way to eliminate conflicts of interest that come with earning commissions). However, the financial planning that we provide for clients is where the real value is. It’s easy for me to see why people still see the fee in terms of investment management, rather than the value that they receive from financial planning, since they are charged a fee as a percentage of their assets that our firm manages.

Earn Your Fees

Sometimes, it’s difficult to communicate to potential clients the value of our financial planning services. No matter how the value is portrayed from our end, some people still have the notion that we have to earn enough excess return above the market to pay for our fees.

Do you do your job for free?

What other profession is expected to provide you a service and pay for it themselves? It’s not necessarily wrong to think that an advisor should earn you a return above the market return (although it’s not necessarily likely, either), but it shows that they’re not considering the value of all the financial planning that we would do for them in addition to the investment management that we’d provide for them.

People will purchase expensive houses and cars, buy the newest tech gadgets every year, and go out to eat every night, but are hesitant to invest in their future because they have a hard time getting past the fees of financial planning. You can see the prices of financial planning listed on websites, but you can’t necessarily see the value. The value is on an individual basis and that’s up to the consumer to determine.

How much time and money have you spent on stuff that didn’t really make your life that much better and you still don’t know if you’ll be able to reach your financial goals or if you’re doing everything you need to be doing to provide the life that you envision for yourself and/or your family?

Is anything going to change if you continue on the path that you’re on?

Value of Financial Planning

What would it mean to you if you could invest in yourself and your financial future and find more concrete answers to all of your financial questions based on your personal situation? Peace of mind? Less stress? Less worrying about your future?

Sometimes “costs” need to be looked at through a “value” lens, instead.

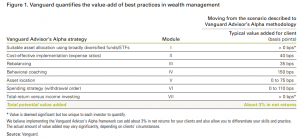

Putting a monetary value on financial planning services would be difficult, but is something that Vanguard has done since 2001 through their annual Vanguard Advisor’s Alpha whitepaper. In 2016, Vanguard published a whitepaper named Putting a value on your value: Quantifying Vanguard Advisor’s Alpha which concluded that advisors who use the strategies outlined in the original whitepaper (Market Street is a firm which utilizes these strategies) can provide alpha (otherwise known as additional value) of about 3% in net returns. Obviously, this isn’t a tried and true number, but an estimate, as it varies from situation to situation.

How’s that for excess returns that pay for your fee?

Financial Planning vs Investment Management

One of the most interesting things to me is that Vanguard estimates that advisors add about 1.50% of value through behavioral coaching and 1.10% of value through spending strategy (withdrawal order during retirement). Compare this to Vanguard’s estimated typical value added for clients through investment activities: suitable asset allocation at 0%, cost-effective implementation (expense ratios) at 0.40%, rebalancing at 0.35%, and asset allocation at 0.75% for a total of 1.50%.

According to Vanguard, the majority of the value of a financial planner is the advice that they provide and keeping clients from making irrational decisions, not from the investment activities that they help you with. Although, 1.50% value added through investment management isn’t too shabby.

However, many of those people who are concerned with fees fail to recognize this value. On the other hand, financial planners probably don’t do a good enough job at tracking these values and portraying them to clients and prospects on a regular basis.

What’s the value of:

- Knowing how much you need to save to retire when you want to?

- Knowing when you can retire based on your current assets and savings rate?

- Knowing how much you can spend in retirement based on your situation?

- A tax-efficient withdrawal strategy during retirement?

- Tax planning strategies that help to become much more tax-efficient which saves you taxes? (Hint: It’s probably the amount of taxes you didn’t have to pay)

- Knowing that you have all of the proper insurance coverages in place with all of the correct terms and conditions (health, life, disability, home, auto, long-term care, etc.)?

- How much more valuable is it if a planner finds that you have an unfavorable disability insurance policy with less-than-adequate coverage and an unfavorable definition of disability and you ended up having to use the policy?

Being coached through the business cycle and market noise as you see your portfolio value fluctuate? (Vanguard estimates the value at 1.50%, which more than likely pays for your fee)

- Remember in January 2016 when the Royal Bank of Scotland told everyone to sell everything? A good financial planner would have told clients to hold tight and those clients have been rewarded with 49.74% US equity gains since the time of that article on January 11, 2016 (this isn’t a perfect example since clients likely aren’t 100% in the S&P, but just an example).

Maximizing your employee benefits?

Developing a strategy for the equity compensation (stock options, restricted stock units, etc.) you receive through your employment?

Developing a plan to save and pay for your children’s college educations?

Creating a savings and debt paydown strategy?

Helping with a home purchase decision?

Helping create and monitor a budget?

Maximizing Social Security?

Analyzing pension options?

Analyzing and determining charitable giving strategies?

Estate planning document review and analyzing and making sure that beneficiaries are updated and correct on all financial accounts?

And more.Are these all things that you can do on your own or that you want to pay the cheapest price possible for?

Price should be considered in relation to value.

You know what they say: You get what you pay for.

Binge Spending

3 minute read

When I think about the term “binge” I immediately think of binge eating, binge Netflix-ing, or binge drinking. When I use the term “binge spending”, this is exactly what I mean – spending a lot of money in a short amount of time.

Binge Eating

I compare this to a diet. You’re doing well on your diet for a couple of weeks when one of your friends asks you to go out for pizza. You think, “Okay, I’ll do really well this week and save some calories for pizza and maybe a couple of beers Friday night with friends.” When Friday night comes around, you’ve done well all week and have set yourself up so you can enjoy some pizza and a couple of beers with your friends without any guilt.

But, by the time you’re done you’ve had a whole pizza by yourself and enough beer to drown a whale.

Then, the next day you think, “I already messed up yesterday, and I feel bad about it, so cheating again today isn’t going to be a big deal.” You’re mentally fatigued from all the restriction. Now, you’ve got some momentum going down the wrong path and you’re more likely to make poor decisions again. I’ve seen it happen to myself and to others.

“Just this once” turns into a habit.

Restriction Can Cause Bingeing

This is exactly why traditional diets don’t work well. They’re too restrictive. Once you get a taste of something that your diet restricts, you continue wanting more and more of it. Your body doesn’t work on a 24-hour clock and neither does your money. Your body is constantly functioning and works on a long-term timeframe as does your personal financial situation. You’re likely going to be alive for a long time, according to statistics, and the one-time binge isn’t going to have a significant impact over that timeframe as continued bingeing will. You can fit those extra calories in or that extra spending into your budget if you change the timeframe in which you’re measuring it as a failure.

Sure, people lose weight from following diets all the time, but the real problem is that they regain that weight the majority of the time. I’ve read someone make a statement before that “America doesn’t have a weight loss problem, it has a weight regain problem.” I don’t think this is too far off. How many times do you see someone do really well and lose weight just to regain it a year or two later?

The same can be said for your financial situation but personal finance isn’t as public as weight loss, so it’s harder to see in people’s lives. People will post on social media all the time and say, “I can’t believe I’ve lost 10 pounds in a week! #FitFam #Fitspiration” (There’s a whole slew of problems with this statement that I’m not even going to get into). No one ever posts and says, “Hey guys, I’ve been really diligent in making personal finance changes and spending wisely and I saved $500 this week compared to what I’d usually spend!”

Binge Spending

Binge spending happens to people when they’re making great progress towards their financial goals just like binge eating happens to people when they’re making great progress towards their physique goals.

Don’t be so restrictive in your spending and budgeting that you go off the rails when you finally treat yourself or buy something that you’ve been wanting. Build some treats and things that you enjoy into your budget regularly. You need to allow yourself to spend money on things that you enjoy. Otherwise, what’s the point in earning more money than necessary to cover the basics?

Prolonged bouts of poor financial decisions will have a much greater impact on your financial situation than one bad choice. Don’t let yourself go down a path of “binge spending” because you’re so restrictive on yourself that once you do actually spend on something you get a little taste that you want more and more of. Continuing to spend money on things that you haven’t planned for just takes you that much farther away from reaching your financial goals.

Whenever you make a poor money decision, just accept it and get back on track. Don’t compound the negative effects by continuing to make more negative financial decisions just because the first one gave you momentum to do so.

I also probably wouldn’t recommend a “Treat Yo Self Day”, unless you’ve budgeted for it.

Parks and Recreation – Treat. Yo. Self

I do not own this