I get up at 4 AM three days per week and I don’t use the snooze button. I do have a trick though. I set an alarm 5 minutes before I want to get out of bed and then I actually do get out of bed once my “wake up” alarm goes off. (It’s not cheating.) Most people think I’m crazy for getting up so early and heading to the gym before work and they tell me how hard it is for them to get out of bed in the morning. My response, “The hardest part is making your feet hit the floor.”

Progress

Progress Not Perfection

Last week, I had the opportunity to speak to the Indianapolis chapter of the Young Nonprofit Professionals Network Indy (YNPNindy) for their November Professional Development event titled Financial planning on a Nonprofit Salary.

Back In The Groove

I’ve fallen off the wagon when it comes to blogging over the past couple of weeks. I started posting mini blogs to social media in the beginning of 2018 and created this website in May 2018. I think this is the first time I’ve struggled this much with writer’s block and coming up with ideas to write about along with being so busy that I haven’t found the time to sit down and be intentional about writing down ideas and topics to brainstorm. Hitting a bump in the road like this can affect many areas of your life from writing and creating ideas to fitness to spiritual to your personal finances to everything. I think the key is to not let it discourage you and become such a large hurdle that you let it get in the way of your progress. Progress may be slow, nonexistent, or even negative at times, but what really matters is what happens over the long-term. Having a short period of slow or no progress doesn’t mean that it will be a long-term trend or even that it will have a significant effect over the long run.

Getting Back on Track

3 minute read

We don’t want to make it a habit to continue to do this and justify it as just a one-time thing that won’t have much of an impact over the long-term, because then it will become a habit and it will have an affect on reaching our goals. What we should is do not dwell on it and get back on track.

Another Holiday Mistake

Maybe you not only blew your diet out of the water over Thanksgiving, but you also blew through your budget. You didn’t plan on buying all of that stuff but then Black Friday deals and new and shiny and…Yeah, I get it. Unlike with what you ate, you can return the things that you bought and get your money back if you really don’t need or want them (hopefully, you don’t see that as an option for the food you ate, too).

However, if you could afford those things without affecting your progress towards your goals, and they’ll provide long-term value to you, then you can just keep them. There’s no need to worry or feel guilty about spending money that doesn’t negatively affect you reaching your goals because you’ve obviously budgeted to spend that money at some point.

Get back on track, follow your budget, and keep making progress towards your goals.

What you don’t want to do is to develop the “screw it” attitude and tell yourself that it’s okay to continue to buy things that you don’t really need or want because you’ve already screwed up. Well, I’ll just buy this one more thing that I really want. Oh, well, I really like that thing too and I already messed up my budget, so I might as well go ahead and buy it. The rabbit hole can be a tricky place to get out of.

Here are 3 tips to get back on track after overspending during the holidays:

Reevaluate Your Budget

Take some time to sit down and review your budget. Make any changes necessary to reflect your projected spending in December and create a plan for how you want your money to work for you. You could plan to spend less in the upcoming months to make up for your overspending this month, but how likely are you to stick to this once the time comes?

If you overspent significantly, then you may want to consider budgeting for these expenses beginning in January for next year. For example, if you think that you’ll end up spending $1,000 on Black Friday in 2019, then budget to save $91 per month from January through November.

Keep Your Eyes on the Prize

You’re going to see a ton of advertisements and “deals” in December. Don’t be tempted to go off budget and spend money on something that you haven’t budgeted for and don’t really need or want. If you needed it or wanted it that badly, then you would have included that within your December spending projections or, if it’s a big ticket item, you would have started saving for it a while ago.

The prize isn’t that new gadget that you see an ad for on TV and feel compelled to buy, the prize is knowing that you’re one step closer to reaching your goals and to financial freedom

Track Your Progress

Make a point to sit down each week and record your spending. Take note of how much you’ve spent in comparison to your projections and if you need to adjust to compensate for overspending or if you have some wiggle room to buy something that you haven’t planned on. Or, you could save any extra money and get a head start on your 2019 savings goals.

Proactively tracking your progress not only keeps you aware of where your money is going each week, but it can also serve as a weekly dose of motivation to make adjustments to make sure that you reach your goals.

Thanksgiving has come and gone – don’t worry too much about how many thousands of calories you ate that you maybe shouldn’t have or the money that you didn’t really plan to spend. Getting off track every once in a while doesn’t mean that you’ve ruined everything, but it also shouldn’t be used as an excuse to continue making the problem worse. Learn from the mistakes that you made, make them better if you can, and set a plan of action to help make sure that you don’t make those same mistakes again in the future.

Be A Doer

4 minute read

I know that I’m this person at times as well, but I hope that people don’t generally have that thought about me. Sometimes, I let “paralysis by analysis” take over and I let myself get stuck in a rut rather than continuing to move forward. This usually happens because I feel like I don’t know how to do something well enough or I feel like I still don’t know all of the details and intricacies of the concept to do it as well as I’d like – the downside of being a perfectionist.

Set A Date

When I was in high school and college, I always felt like the goal setting activities we had to do were a waste of my time. However, now that I think about it, I’ve always used goals in some form or another and I now realize that those activities definitely weren’t a waste. I think it’s important to set dates for your goals so that you can measure your progress and have a sense of urgency as the date nears. You may fail if you set a date, but I guarantee you’ll be closer to reaching your goal by that date than you’d be if you hadn’t set it.

You want to increase your net worth by 20%? Set a date. You want to lose 15 pounds? Set a date. You want to start a blog? Set a date.

Setting the date can help you reach your goal, but what you do after you’ve reached that goal is just as equally important. There’s no use in increasing your net worth by 20% if you’re going to celebrate by going into debt and erasing that progress. There’s no use in losing those 15 pounds if you’re going to quit exercising and watching your consumption and you just gain all the weight back. There’s no use in starting a blog if you only post to it for a couple of months and then quit.

Share Your Passion With Others

One reason I thought to write this post is because I had a great conversation today with someone who is moving from the “talking stage” of an idea that he’s been passionate about for a while now to the “doing stage”. Not only does this make me happy because he’s my friend and I know it’s something that he’s been wanting to do, but it also motivates me to continue progressing and pushing myself out of my comfort zone. Having conversations with others who are driven and want to do what they can to make a bigger impact with their lives always lights a fire underneath me and gives me motivation to be a doer.

I don’t think you have to make all your aspirations public. I think that you can find a single person or a small group of people who you know will encourage you to reach your goals on a consistent basis and will be happy to see you succeed. All it takes is one good conversation a week to keep you motivated.

Just Do It

If you’re not happy with where you are or feel like you don’t have a clear sense of direction, then do something today to get closer to your goal. No one’s going to do it for you and there’s never going to be a better time than now. The sooner you start doing something to reach your goals, the more time you have to refine the process, figure out what works for you, and be successful.

Of course, it’s much better to have a solid plan in place to make sure that you don’t screw something up really badly, but that’s why we can hire people such as coaches, teachers, trainers, and financial planners who have a much more in-depth knowledge and can help us eliminate some errors and mistakes that could prove to be very costly. But, they can’t help us if we’re not willing to set things in motion and help ourselves first.

If you want something bad enough, then you’ll quit making excuses and you’ll find a way to make it happen. No matter what. You don’t have to have a perfect idea about how to do something or have a perfect plan in place. You’ll make mistakes and learn along the way.

“I’m gonna tell you a secret about everyone else’s job. No one knows what they’re doing…Deep down everyone is just faking it until they figure it out. And you will too. Because you are awesome and everyone else sucks.” – April Ludgate

April & Andy: I’m going to tell you a secret about everyone else’s job

“I’m going to tell you a secret about everyone else’s job: No one knows what they’re doing. Deep down, everyone is just faking it until they figure it out. And you will, too, because you are awesome and everyone else sucks.”

Increase Your Net Worth By 7,307% In One Year? It Can Happen.

< 1 minute read

There wasn’t some miracle that had to happen to do this and she didn’t win the lottery. She didn’t buy some product that promises to take care of all of your financial woes and she didn’t start selling products from an MLM that promise to make you rich beyond your wildest dreams.

It’s simply a result of staying disciplined and executing a plan. There’s probably been much less discretionary spending on clothes, going out with friends, eating out, and hair appointments than she would like, but it has clearly paid off. She’s had to keep her long-term goals in mind to make sure that those old day-to-day spending habits wouldn’t derail her progress.

She used a simple formula that can work for anyone:

Live Below Your Means + Save + Invest + Focus on Paying Down Debt = Financial Success

She did start at a negative net worth last year (not anymore), and it’s likely that her net worth will go down over the coming years since she’s going back to college to finish her degree, but she’s buckled down and done what she can over the past year to put herself in a much better position to do so without completely wrecking her financial situation.

I’m proud of her for that.

Track Your Net Worth

< 1 minute read

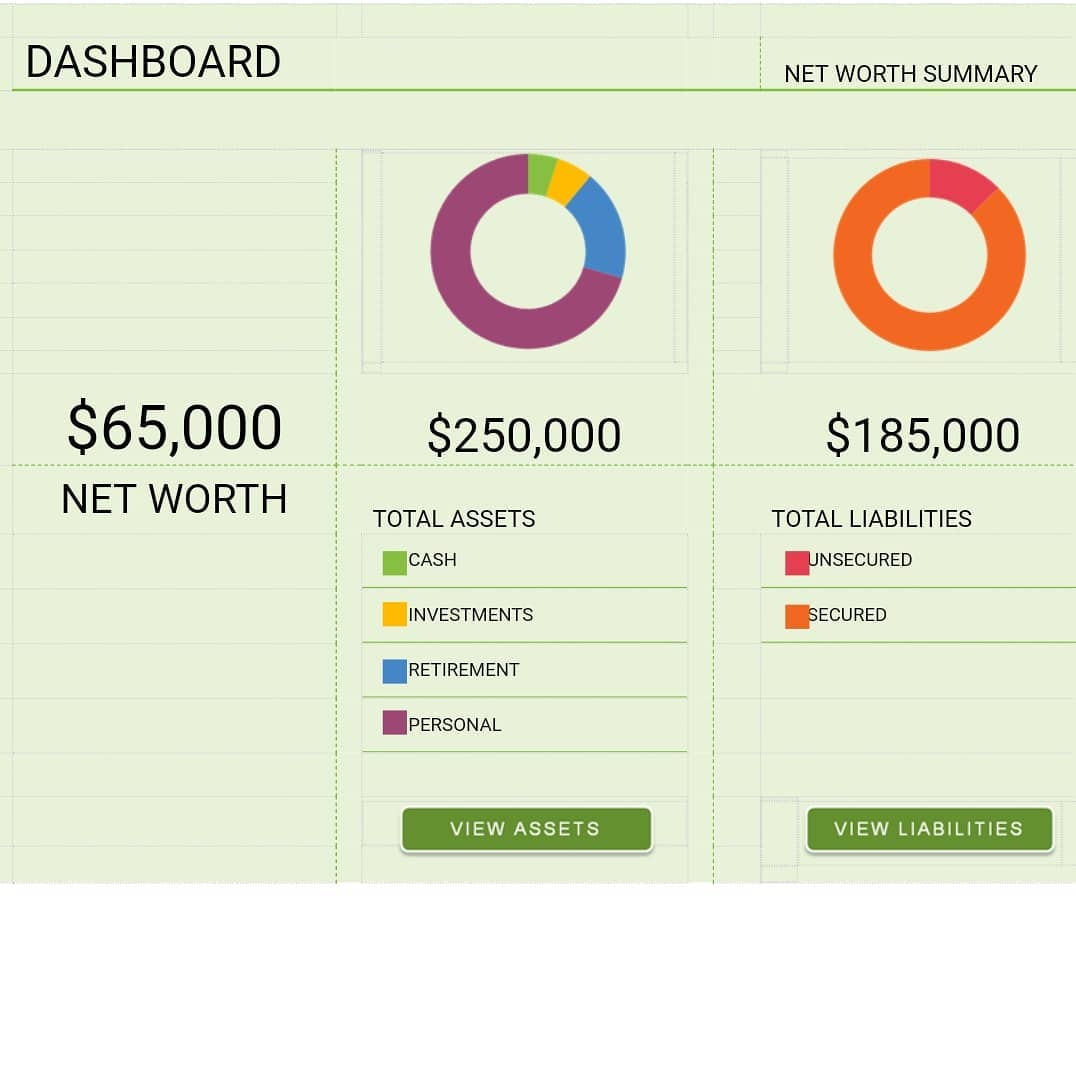

Seeing my progress on a monthly basis has kept me motivated and dedicated towards my financial goals, especially now that I have multiple years’ worth of progress documented that I can reflect on.

You can easily use a net worth template in Excel like the one in the picture to get started tracking your progress towards your goals and get a better representation of your financial life. It really only takes less than 10 minutes for me to update my net worth statement each month.

How do you track your progress towards your goals and stay motivated?

*This is not my personal information*