What if you were able to come out of this time of social distancing and economic crisis with a stronger and healthier financial life? What if you looked at this as an opportunity to take a little bit of your extra time each day to work on your finances?

Net Worth

Personal Finance Systems

Every day, the first thing that I do when I get home from work is unpack my gym bag and put the dirty clothes in the clothes basket, hang up the clothes that aren’t dirty and get into something more comfortable, and get everything that I need ready for the next day. Why? Because it makes my life easier.

5 More Personal Finance Wins to Keep Making Progress in 2020

I’m already starting to see it in the gym – the number of people who are there in the mornings when I am have dropped back down to pre-New Year levels. The week of January 6th was packed (more than in previous years it seems like) but the number of people have continued to dwindle week-by-week since then. According to US News, 80-something percent of people who set New Year’s resolutions give up by the second week of February. We’re not quite there yet, but I can already see the difference.

Halfway Through 2019

Somehow, we’re already halfway through the year. I have no idea how that happened, but it did and there are some things that we can do now to evaluate our progress towards our goals, and get ourselves back on track if we need to, that will help to set us up for success over the next 6 months to end the year strong.

Increase Your Net Worth By 7,307% In One Year? It Can Happen.

< 1 minute read

There wasn’t some miracle that had to happen to do this and she didn’t win the lottery. She didn’t buy some product that promises to take care of all of your financial woes and she didn’t start selling products from an MLM that promise to make you rich beyond your wildest dreams.

It’s simply a result of staying disciplined and executing a plan. There’s probably been much less discretionary spending on clothes, going out with friends, eating out, and hair appointments than she would like, but it has clearly paid off. She’s had to keep her long-term goals in mind to make sure that those old day-to-day spending habits wouldn’t derail her progress.

She used a simple formula that can work for anyone:

Live Below Your Means + Save + Invest + Focus on Paying Down Debt = Financial Success

She did start at a negative net worth last year (not anymore), and it’s likely that her net worth will go down over the coming years since she’s going back to college to finish her degree, but she’s buckled down and done what she can over the past year to put herself in a much better position to do so without completely wrecking her financial situation.

I’m proud of her for that.

Track Your Net Worth

< 1 minute read

Seeing my progress on a monthly basis has kept me motivated and dedicated towards my financial goals, especially now that I have multiple years’ worth of progress documented that I can reflect on.

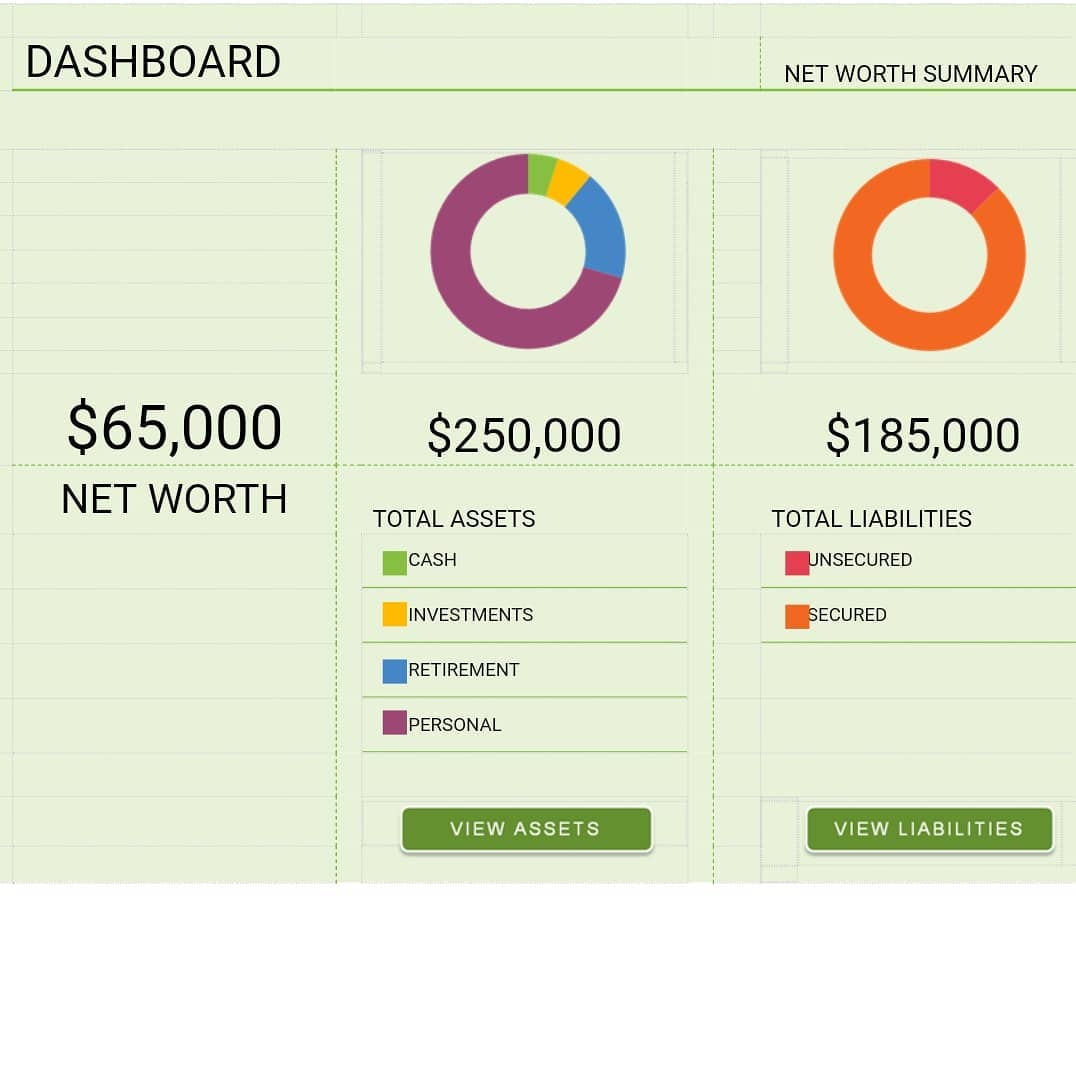

You can easily use a net worth template in Excel like the one in the picture to get started tracking your progress towards your goals and get a better representation of your financial life. It really only takes less than 10 minutes for me to update my net worth statement each month.

How do you track your progress towards your goals and stay motivated?

*This is not my personal information*