Financial planning includes investment planning, but investing is not financial planning. A couple of weeks ago, I wrote about what a financial planner does. It still surprises me how many people I speak to who think of a financial planner as being synonymous with an investment portfolio manager. This is not the case. A financial planner who provides comprehensive wealth management services provides both financial planning and investment portfolio management, but investing is just part of the service. A financial plan needs to be in place to direct and guide the portfolio.

Investment Management

How Much Impact Does the President Have on the Stock Market?

I don’t need to tell you how contentious this election season has been. Personally, I can’t wait to stop seeing all of the political ads and I’d rather have a different topic to have to make small talk about. People on both sides of the political spectrum often become worried about how the result of the election will impact their investment portfolio. No matter what side you’re on, if the other side wins, then you think it’s going to be doomsday for your retirement dreams. So, how much impact does the President have on the stock market? A lot less than most people think.

Why Should We Practice Portfolio Diversification?

If you owned a fruit stand and you only sold oranges, then you would be in a bad spot if a hurricane wiped out all of the orange groves that you get your fruit from. However, if you sold a bunch of different fruits alongside oranges like bananas, apples, and berries, then you would still be able to make money when you couldn’t get oranges to sell. You could also use different fruit suppliers so that if something were to happen to the fruit crops in one place you would still be able to get fruit to sell from one of your other suppliers. This is a simple example of the concept of diversification.

You Need Permission to Play

“Be fearful when others are greedy, and greedy when others are fearful.” – Warren Buffett

Please Quit Taking Investing Advice From Celebrities

Please stop relying on financial advice and investment tips from celebrities.

Day 7 Of 30 Days Of Stay-At-Home Personal Finance Wins: Don’t Panic

What if you were able to come out of this time of social distancing and economic crisis with a stronger and healthier financial life? What if you looked at this as an opportunity to take a little bit of your extra time each day to work on your finances?

What Is Financial Planning?

4 minute read

Financial Planning Process

Financial planning does not start with someone selling you a product. While a financial salesperson can engage a client in financial planning, they’re proving to you up front that they’re not working in your best interest by selling you a product that they’re set to make a nice commission on. As outlined by the CFP Board, the financial planning process includes 6 steps:

- Establishing and defining the client-planner relationship

- Gathering client data including goals

- Analyzing and evaluating the client’s current financial status

- Developing and presenting recommendations and/or alternatives

- Implementing the recommendations

- Monitoring the recommendations

If someone comes to you selling a financial product such as life insurance or an annuity before completing these first three steps, then they’re not helping you with financial planning and they’re not acting as a fiduciary for you (not everyone who calls themselves a financial planner is obligated to always act in your best interest). There’s a big difference between a fee-only financial planner and someone who is selling you a financial product (Here are some tips to find a qualified financial planner).

The process of financial planning involves taking an extremely deep dive into a client’s financial situation and helping them develop achievable financial goals. It should be a collaborative process between the financial planner and the client and can sometimes take just as much work from the client as it does from the planner. The beginning steps require a client to provide a lot of information to a financial planner that they oftentimes don’t know where it is or don’t have organized well.

Once the information is gathered, it’s time for the financial planner to go to work evaluating everything they’ve been given and seeing where they can fill holes in the information. A financial plan is created taking into consideration all of a client’s current financial resources, the goals that they have, and what they can and are willing to do to get there. Finally, a client and financial planner meet to review the information, tweak anything that was lost in translation, and define follow-up tasks.

Once these steps are complete, it’s time to implement and monitor recommendations. While the recommendations are probably the most important outcome of the financial planning process, they too often fall to the wayside and don’t get completed. It’s understandable – people have busy lives and they’re not always motivated to think about what they need to do to improve their finances. Life gets in the way. That’s why it’s important that their financial planner is there to help them with the tasks that they can and to continue to remind the client to complete the tasks that the financial planner can’t complete for them.

Financial Planning Subject Areas

What exactly do financial planners help clients with? Depending on the scope of the engagement with a client, a financial planner should be able to help with all the following:

- Financial statement preparation and analysis (including cash flow analysis/planning and budgeting)

- Insurance planning and risk management

- Employee benefits planning

- Investment planning

- Income tax planning

- Retirement planning

- Estate planning

A financial plan should be a condensed version of all of the steps and financial planning subject areas above that tells you where your current financial situation is, where it needs to go/how you can reach your goals, and the steps and recommendations to get there.

However, some financial planners will do modular financial planning for clients where they will complete one of the aspects of financial planning listed above such as a college funding analysis or life insurance analysis. A comprehensive financial plan would include an analysis of all of the subject areas.

How Do You Pay For A Financial Plan?

There are many ways to pay for a financial plan outside of paying a commission for purchasing a financial product. These include being charged as a percentage of your assets that a financial planner manages for you, paying a one-time fee directly for a standalone financial plan, or paying a retainer for ongoing advice such as you would with a lawyer, among many, many other payment structures.

Financial planning is a growing field separate from traditional investment management and financial product sales and the ways to pay for financial planning services are growing in number along with it.

A Financial Plan Is A Map

Financial planning is more than just trading stocks. While most financial planners do manage clients’ investments, the financial plan should be where they start. How can your financial planner know how to properly manage your investments for you without first knowing your goals and your comprehensive financial picture? Investment management without a financial plan is like going on a cross country road trip without a map or a GPS. You may know where you want to go, and you may know generally how to get there, but it will be much easier and much more straightforward with a proper plan in place.

Where Should I Setup a Retirement Account?

3 minute read

There are so many options where you can open an account and so many advertisements from companies telling you why they’re the best to use. A Roth IRA is a Roth IRA; there isn’t an advantage from one account to another. The advantage comes from the assets that you’re able to invest in within the account.

Luckily for those looking to open a retirement account (or any other investment account), the large investment companies continue to compete and drive each other’s prices down.

Do It Yourself

There are plenty of custodians with reputable names where you can open an investment account: Schwab, Vanguard, TD Ameritrade, Fidelity, etc. I don’t know all of the specific offerings that each company has, so I’m going to explain more of the general things to look for when determining where you should open an investment account.

Fees

Fees are always one of the top things we need to consider when investing. Why? They are one of the fastest ways to eat up our returns. Which institution you choose to open your account at doesn’t make much of a difference – the assets that the company makes available to you are going to have a much greater impact on your investing success.

You want to make sure that the company that you choose to setup your investment account with provides you with access to good mutual funds and ETFs that have good long-term performance and low fees. Fees can include trading fees charged by the institution where your account in setup, loads on mutual funds, and expense ratios that the mutual funds charge on an ongoing basis.

As mentioned above, the good thing for retail investors is that these companies continue to drive each other’s prices down. In fact, Schwab now offers no-load, no transaction fee mutual funds to retail investors. One thing to keep in mind is that there may be account minimums or monthly contribution minimums that these companies require to open an account and access these funds and low fees. Additionally, you want to make sure that the expense ratio on the mutual funds isn’t high to make up for not charging a load or transaction fee.

However, there are some companies where you can setup an investment account that only allow you to invest in their own mutual funds and ETFs. In general, this should be a no-go. These companies typically charge very high expense ratios and their investments often under perform their benchmarks. Conversely, those companies that I mentioned by name above (this is not an all-inclusive list) allow account holders to choose from the (almost) full universe of mutual funds and ETFs. This means that you can pick the very best investments available, even if they are from a competitor of the company where you have your account.

Custodians for Financial Planners

I work at a fee-only Registered Investment Advisor (RIA) that uses Schwab as a custodian. A custodian is important because it means that we never have control of our clients’ money. Instead, we setup accounts at Schwab for our clients, in their names, which provides us with limited power of attorney to trade their accounts and send money between like-named accounts (i.e. transfer money between their checking account and investment account).

If you decide that you would like to work with a financial planner, they will likely have their preferred custodian where they will ask you to house your assets. Financial planners have chosen custodians because it makes their jobs easier and their clients’ lives easier. The planners are provided with a service team with the custodian, they know all of the processes and procedures to complete various tasks with the custodian, and client accounts are in one place which makes life much easier than if they were scattered amongst various clients’ preferred investment companies.

In addition to working with an experienced advisor, there are additional advantages to opening an account with a financial planner compared to opening a retail account on your own such as more favorable share classes available as well as different mutual fund families that aren’t available to the public.

Please keep in mind that the only check you should ever write to your financial planner is to pay your fees. You should never write a check directly to your financial planner for an account deposit – deposits will always be made out to the custodian for benefit of you with your account number on the payment.

Conclusion

Overall, where you open an investment or retirement account doesn’t make a huge difference. The things that you want to be aware of are the investment choices available to you, the fees that you’ll incur, and the level of service you believe you’ll receive.

What’s The Value

4 minute read

I work for a firm that charges clients a fee as a percentage of the investable assets that we manage for them (we charge this way to eliminate conflicts of interest that come with earning commissions). However, the financial planning that we provide for clients is where the real value is. It’s easy for me to see why people still see the fee in terms of investment management, rather than the value that they receive from financial planning, since they are charged a fee as a percentage of their assets that our firm manages.

Earn Your Fees

Sometimes, it’s difficult to communicate to potential clients the value of our financial planning services. No matter how the value is portrayed from our end, some people still have the notion that we have to earn enough excess return above the market to pay for our fees.

Do you do your job for free?

What other profession is expected to provide you a service and pay for it themselves? It’s not necessarily wrong to think that an advisor should earn you a return above the market return (although it’s not necessarily likely, either), but it shows that they’re not considering the value of all the financial planning that we would do for them in addition to the investment management that we’d provide for them.

People will purchase expensive houses and cars, buy the newest tech gadgets every year, and go out to eat every night, but are hesitant to invest in their future because they have a hard time getting past the fees of financial planning. You can see the prices of financial planning listed on websites, but you can’t necessarily see the value. The value is on an individual basis and that’s up to the consumer to determine.

How much time and money have you spent on stuff that didn’t really make your life that much better and you still don’t know if you’ll be able to reach your financial goals or if you’re doing everything you need to be doing to provide the life that you envision for yourself and/or your family?

Is anything going to change if you continue on the path that you’re on?

Value of Financial Planning

What would it mean to you if you could invest in yourself and your financial future and find more concrete answers to all of your financial questions based on your personal situation? Peace of mind? Less stress? Less worrying about your future?

Sometimes “costs” need to be looked at through a “value” lens, instead.

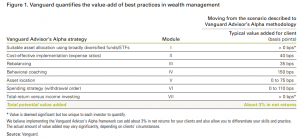

Putting a monetary value on financial planning services would be difficult, but is something that Vanguard has done since 2001 through their annual Vanguard Advisor’s Alpha whitepaper. In 2016, Vanguard published a whitepaper named Putting a value on your value: Quantifying Vanguard Advisor’s Alpha which concluded that advisors who use the strategies outlined in the original whitepaper (Market Street is a firm which utilizes these strategies) can provide alpha (otherwise known as additional value) of about 3% in net returns. Obviously, this isn’t a tried and true number, but an estimate, as it varies from situation to situation.

How’s that for excess returns that pay for your fee?

Financial Planning vs Investment Management

One of the most interesting things to me is that Vanguard estimates that advisors add about 1.50% of value through behavioral coaching and 1.10% of value through spending strategy (withdrawal order during retirement). Compare this to Vanguard’s estimated typical value added for clients through investment activities: suitable asset allocation at 0%, cost-effective implementation (expense ratios) at 0.40%, rebalancing at 0.35%, and asset allocation at 0.75% for a total of 1.50%.

According to Vanguard, the majority of the value of a financial planner is the advice that they provide and keeping clients from making irrational decisions, not from the investment activities that they help you with. Although, 1.50% value added through investment management isn’t too shabby.

However, many of those people who are concerned with fees fail to recognize this value. On the other hand, financial planners probably don’t do a good enough job at tracking these values and portraying them to clients and prospects on a regular basis.

What’s the value of:

- Knowing how much you need to save to retire when you want to?

- Knowing when you can retire based on your current assets and savings rate?

- Knowing how much you can spend in retirement based on your situation?

- A tax-efficient withdrawal strategy during retirement?

- Tax planning strategies that help to become much more tax-efficient which saves you taxes? (Hint: It’s probably the amount of taxes you didn’t have to pay)

- Knowing that you have all of the proper insurance coverages in place with all of the correct terms and conditions (health, life, disability, home, auto, long-term care, etc.)?

- How much more valuable is it if a planner finds that you have an unfavorable disability insurance policy with less-than-adequate coverage and an unfavorable definition of disability and you ended up having to use the policy?

Being coached through the business cycle and market noise as you see your portfolio value fluctuate? (Vanguard estimates the value at 1.50%, which more than likely pays for your fee)

- Remember in January 2016 when the Royal Bank of Scotland told everyone to sell everything? A good financial planner would have told clients to hold tight and those clients have been rewarded with 49.74% US equity gains since the time of that article on January 11, 2016 (this isn’t a perfect example since clients likely aren’t 100% in the S&P, but just an example).

Maximizing your employee benefits?

Developing a strategy for the equity compensation (stock options, restricted stock units, etc.) you receive through your employment?

Developing a plan to save and pay for your children’s college educations?

Creating a savings and debt paydown strategy?

Helping with a home purchase decision?

Helping create and monitor a budget?

Maximizing Social Security?

Analyzing pension options?

Analyzing and determining charitable giving strategies?

Estate planning document review and analyzing and making sure that beneficiaries are updated and correct on all financial accounts?

And more.Are these all things that you can do on your own or that you want to pay the cheapest price possible for?

Price should be considered in relation to value.

You know what they say: You get what you pay for.