I want to retire with $1 million.

Retirement

Day 18 Of 30 Days Of Stay-At-Home Personal Finance Wins: Increase Your Retirement Account Contributions

What if you were able to come out of this time of social distancing and economic crisis with a stronger and healthier financial life? What if you looked at this as an opportunity to take a little bit of your extra time each day to work on your finances?

5 Easy Personal Finance Wins for the New Year

“If you haven’t started, then taking action is more important than finding the best strategy. If you’re already taking action, then ensuring you’re working on the right thing is more important than working harder.” – James Clear, Atomic Habits

Guide to Employee Benefits Open Enrollment 2019 Part 1: Employer-Sponsored Retirement Plans

This is part 1 of a series where I’ll be providing general education on many of the employee benefits elections that you’ll be faced with during open enrollment season. While there are some employers whose employee benefits open enrollment has already closed, many companies don’t have open enrollment until October or November. I find that many people take their best guess at making their enrollment elections, but have never really been well-educated on the decisions that they have in front of them or what might be best for their personal situation and don’t necessarily understand everything that they’re opting into or out of. Something that can make this even more confusing is having a spouse who’s employed at a company that provides benefits and trying to figure out how each employer’s benefits can work together for you. I’m hoping that this series of posts can help provide some education around some of the common benefits offered by employers and help people make better decisions for what might be best for their personal situation.

Rule Of Thumb

There are a lot of financial rules of thumb that are thrown around in articles, on TV, and by so-called personal finance “experts”. What are some of these rules of thumb and what could be wrong with using them for your personal situation?

IRA

Since I wrote about 401(k)s earlier this week, I figured I’d write about IRAs today. Not everyone has a job that provides an employer-sponsored retirement plan such as a 401(k). When this is the case, an IRA can often be a good alternative to start with to save for retirement.

401(k)

The other day, someone asked me how I feel about 401(k)s. They told me that they weren’t sure about them and that they wanted to invest riskier but they hate not being able to touch it for so many years.

Saving When You Receive A Large Employer Contribution

3 minute read

I’ve seen a handful of retirement plans where the employer contributes 10% – 15% of an employee’s pay to their retirement account without mandating that the employee contribute anything. Most of the times when this is the case the employee doesn’t contribute anything to the account themselves because they think that the employer contribution is sufficient. However, this may not be the best way to go.

Vesting

First, the employer contributions to your retirement plan could be subject to a vesting schedule. This means that the money that your employer contributes to the account may not be all yours until some point in the future. In other words, if you were to leave your job, then you may not be entitled to take all of the money that your employer put into the account for you. It could take years for the money to “vest” and become yours. This is definitely something to consider if you are someone in this position.

Saving Reduces Lifestyle Creep

Saving inherently decreases the amount of money that you spend, which is a good thing because it means that you won’t have to figure out how to replace as much income when you decide you want to retire. On the flip side of that statement, not saving inherently increases the amount of money that you spend and the amount of income that you’ll have to replace to maintain your lifestyle in retirement.

Often when people receive raises or bonuses they let their spending increase without increasing their savings. This is called lifestyle creep. If you’re someone who receives raises and/or bonuses annually but you don’t increase your savings annually, then your spending could increase quickly which will make transitioning into retirement, and potentially a less extravagant lifestyle, more difficult.

Changing Jobs

The stats say you’re going to change jobs. If you have a large percentage of your pay contributed to your retirement account by your employer and you don’t contribute anything yourself, what happens if you switch jobs and your new employer doesn’t contribute nearly as much or requires you to contribute to receive a match?

This could mean that you have to decrease your spending and lifestyle significantly to ensure that you maintain an adequate savings rate.

It’s Up To You

Even if you’re only capable of doing so for a limited period of time, saving your own money to your retirement account early will provide much more flexibility in the future. Saving doesn’t have to be an all or nothing game – depositing a few dollars tomorrow that aren’t in your account today can pay off over time. Additionally, saving more while you’re young and have less financial responsibilities may mean that you have more flexibility to save less in the future or save less in certain periods of your life that call for spending more.

Sure, it’s more fun to spend the money that you make rather than save it, but no one else is going to be there to be there when you want to retire waiting to pay for all of your expenses. While I’m not someone who works at a company that provides a 10%-15% contribution to my retirement plan, I am fortunate enough to receive a 3% contribution as well as additional profit sharing contributions. When I calculate my personal savings rate, I do not include any of those contributions that my employer provides. Partially because some of them are on a vesting schedule, but mainly because I know it’s important that I save a significant portion of my income to ensure that I reach my long-term financial goals

Where Should I Setup a Retirement Account?

3 minute read

There are so many options where you can open an account and so many advertisements from companies telling you why they’re the best to use. A Roth IRA is a Roth IRA; there isn’t an advantage from one account to another. The advantage comes from the assets that you’re able to invest in within the account.

Luckily for those looking to open a retirement account (or any other investment account), the large investment companies continue to compete and drive each other’s prices down.

Do It Yourself

There are plenty of custodians with reputable names where you can open an investment account: Schwab, Vanguard, TD Ameritrade, Fidelity, etc. I don’t know all of the specific offerings that each company has, so I’m going to explain more of the general things to look for when determining where you should open an investment account.

Fees

Fees are always one of the top things we need to consider when investing. Why? They are one of the fastest ways to eat up our returns. Which institution you choose to open your account at doesn’t make much of a difference – the assets that the company makes available to you are going to have a much greater impact on your investing success.

You want to make sure that the company that you choose to setup your investment account with provides you with access to good mutual funds and ETFs that have good long-term performance and low fees. Fees can include trading fees charged by the institution where your account in setup, loads on mutual funds, and expense ratios that the mutual funds charge on an ongoing basis.

As mentioned above, the good thing for retail investors is that these companies continue to drive each other’s prices down. In fact, Schwab now offers no-load, no transaction fee mutual funds to retail investors. One thing to keep in mind is that there may be account minimums or monthly contribution minimums that these companies require to open an account and access these funds and low fees. Additionally, you want to make sure that the expense ratio on the mutual funds isn’t high to make up for not charging a load or transaction fee.

However, there are some companies where you can setup an investment account that only allow you to invest in their own mutual funds and ETFs. In general, this should be a no-go. These companies typically charge very high expense ratios and their investments often under perform their benchmarks. Conversely, those companies that I mentioned by name above (this is not an all-inclusive list) allow account holders to choose from the (almost) full universe of mutual funds and ETFs. This means that you can pick the very best investments available, even if they are from a competitor of the company where you have your account.

Custodians for Financial Planners

I work at a fee-only Registered Investment Advisor (RIA) that uses Schwab as a custodian. A custodian is important because it means that we never have control of our clients’ money. Instead, we setup accounts at Schwab for our clients, in their names, which provides us with limited power of attorney to trade their accounts and send money between like-named accounts (i.e. transfer money between their checking account and investment account).

If you decide that you would like to work with a financial planner, they will likely have their preferred custodian where they will ask you to house your assets. Financial planners have chosen custodians because it makes their jobs easier and their clients’ lives easier. The planners are provided with a service team with the custodian, they know all of the processes and procedures to complete various tasks with the custodian, and client accounts are in one place which makes life much easier than if they were scattered amongst various clients’ preferred investment companies.

In addition to working with an experienced advisor, there are additional advantages to opening an account with a financial planner compared to opening a retail account on your own such as more favorable share classes available as well as different mutual fund families that aren’t available to the public.

Please keep in mind that the only check you should ever write to your financial planner is to pay your fees. You should never write a check directly to your financial planner for an account deposit – deposits will always be made out to the custodian for benefit of you with your account number on the payment.

Conclusion

Overall, where you open an investment or retirement account doesn’t make a huge difference. The things that you want to be aware of are the investment choices available to you, the fees that you’ll incur, and the level of service you believe you’ll receive.

Playing the Lottery to Get Rich

3 minute read

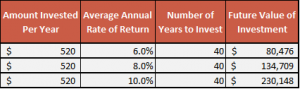

Let’s create a hypothetical situation. Let’s say that Jane Doe thinks that the odds are stacked against her and that she’ll never be able to become wealthy or be able to retire at a reasonable age without winning the lottery. (This is a common mindset among many people I grew up around.) Each week, Jane purchases $10 worth of Powerball tickets with hopes that maybe some day her numbers will be drawn. Since there are 52 weeks in a year, we conclude that Jane spends $520 per year on lottery tickets. Google and do some research and you’ll find that this is not an unrealistic assumption whatsoever.

Now, let’s assume that Jane is 65 years old and that she has spent $520 per year on lottery tickets for 40 years, since she was 25 years old. Maybe most people don’t buy $10 worth of lottery tickets every single week for 40 years, but let’s stick with it.

At age 65, Jane wants to retire but she still hasn’t won the lottery and doesn’t quite have enough in her retirement savings to do so. That’s $20,800 on lottery tickets gone ($520 per year X 40 years) with nothing to show for it.

A Different Approach

What if Jane had a different mindset when she was young and began investing $10 per week rather than using that money to buy lottery tickets? Surely, we could all find $10 per week to invest if we can find $10 per week to spend on other things such as eating out for lunch, clothes, lottery tickets, or anything else, right?

If Jane had invested that $10 per week in a mutual fund that had an average annual return of 6% over 40 years from her age 25 to age 65, then she would have $80,476 at her age 65. Compare that to $0 if she had spent that money on the lottery the whole time and never won.

If she was able to get a better rate of return of 8%, then the money would grow to $134,709. A 10% rate of return would have yielded $230,148 by her age 65 which is 11 times the cost of the lottery tickets over that same time frame.

That could provide some benefit in retirement.

The only reason to play the lottery is because you have absolutely nothing to do with a little extra money and you don’t care that you’re not likely to ever see it again, or for entertainment every now and again. There are much better things that you can do with your money to lead you towards financial freedom.

Becoming financially free is a result of the decisions that you make with your money. Play the odds in your favor.