Why do we need to invest our money for retirement? Why not just stockpile it into a savings account where it feels safe? The stock market is risky, right?

The answer to these questions go back to a post that I wrote last month titled What’s the Riskiest Asset Class? In that post, we learned that the riskiest asset class isn’t necessarily stocks; the riskiest asset class is dependent upon your time horizon for using that money. If you plan on purchasing something today, then stocks would probably be the riskiest asset class for that money because a correction or recession could mean the money could lose value. If you plan on using the money for your retirement, then cash could be considered the riskiest asset class, assuming that you aren’t going to retire within the next 5-10 years.

Historically, there’s been a huge opportunity cost to holding cash rather than investing in the market. It is important to have a cash reserve for an emergency fund as well as for short-term goals, but I’m talking about any cash that you have in your bank account above that amount. Specifically, cash that you have earmarked for retirement.

Inflation

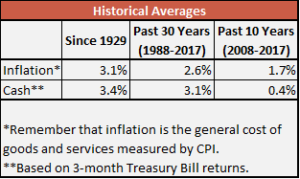

Inflation is the rate at which the price of goods and services rises, based on the Consumer Price Index. When inflation rises, your purchasing power, or how much of a good or service you can buy with your money, decreases. Historically, inflation has been slightly less than the rate of return on cash and much less than returns on stocks. However, over the past 10 years inflation has actually been higher than the rate of return in cash.

As we can see, over the short-term our cash hasn’t kept up with inflation while over the long-term it has eked out slightly greater returns than inflation. This means that over the past 10 years the interest rate on your savings account has likely not been high enough for your cash to keep up with the rising costs of goods and services. If you’ve been holding on to a significant amount of cash over the past 10 years, then that money has lost purchasing power due to inflation over that time. Of course, past performance is not indicative of future results, but it’s the best assumption we have in this case.

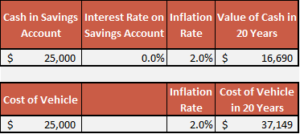

If you have $25,000 in a savings account today that doesn’t earn interest (assuming you will never add any more to the account or use any of the money), it would be worth $16,690 in 20 years with an inflation rate of 2% (the target inflation rate of the Federal Reserve). However, assuming that the price of vehicles inflates at 2%, the cost of a $25,000 vehicle today would be $37,149 in 20 years.

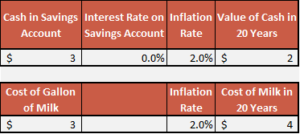

The $3 that you pay for a gallon of milk would cost $4 in 10 years if it inflated at 2.0% per year while $3 in your checking account that isn’t earning any interest would only be worth $2. These are simply examples, but they demonstrate the importance of making sure that your money keeps up with inflation.

Just imagine what the costs of health care and education would look like, considering they have historically inflated at much higher rates than most other goods and services.

Compound Interest

An even more significant reason to invest for retirement is compound interest.

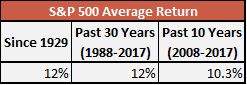

The S&P 500 (which measures the value of the 500 largest publicly traded companies in the US) has averaged annual returns of roughly 12% (rounded and before fees) over the past 30 years and roughly 12% (rounded and before fees) since data has been tracked beginning 1928. Over the past 10 years, the average annual return of the S&P has been lower than the longer-term averages at 10.3%.

As we can see, in the past, investing our retirement savings in the stock market would have rewarded us generously and would have ensured that our money would grow at a much higher rate than inflation. While the stock market is risky in the short-term, the past shows us that we have to take a long-term view and not worry so much about short-term volatility. The average intra-year decline of the S&P 500 is 14%, according to JP Morgan. Despite this, on average, the S&P 500 has a positive return.

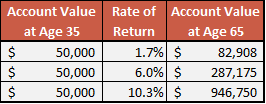

Let’s say that someone age 35 has $50,000 sitting in cash that they’ve earmarked as retirement savings. Assuming that money returns the past 10-year average return of cash of 1.7%, and they never add any more money to it or take any money from it, it would grow to $82,908 by age 65, not accounting for inflation.

Now, let’s assume that they invest that money in the S&P 500 and it returns the past 10-year average of 10.3%. In this case, the $50,000 would grow to $946,750, or over 11 times the amount we see in the example above in the case of cash.

However, most economists and market pundits don’t believe that we will see these types of investment returns from the market going forward. Generally, a rule of thumb that I’ve seen being predicted going forward is 6%. If the person in the example were to invest that $50,000 in the S&P and it returned an average of 6% over the next 30 years, then they would have $287,175 at age 65. This is still almost 3.5 times the amount that the cash would grow to, using the 10-year historical return of cash.

Please note that these are purely hypothetical situations as they don’t account for anyone’s particular situation, don’t take into consideration fees, and are not taking inflation into consideration either.

Historically, there has been a huge advantage to investing for retirement rather than hording cash. Investing wisely could potentially be the difference that allows you to retire early, become financially independent sooner, or live a more desirable lifestyle during retirement than you could afford to otherwise.