Some people absolutely hate the debt that they have and want to get rid of it as soon as possible. Some people (dangerously) have no clue how much debt they have and would rather pretend that it’s not there than to be proactive and do something about it. If you’re one of those people who want to get rid of your debt, then what’s the right way to go about doing so? Do you pay down the highest balance first or the debt with the highest interest rate first? Should you actually be paying down your debt more aggressively than required?

Debt

A 96-Month Car Loan?!

< 1 minute read

I was baffled when my colleague, Aaron Williams, shared this article with me that he saw on Facebook. A 96-month car loan? That’s 8 years. Think about what you were doing 8 years ago.

Be Cautious About Consolidating Student Loans

< 1 minute read

I often see articles citing student loans as one of the main reasons that young people have a hard time saving and are waiting longer to purchase homes.

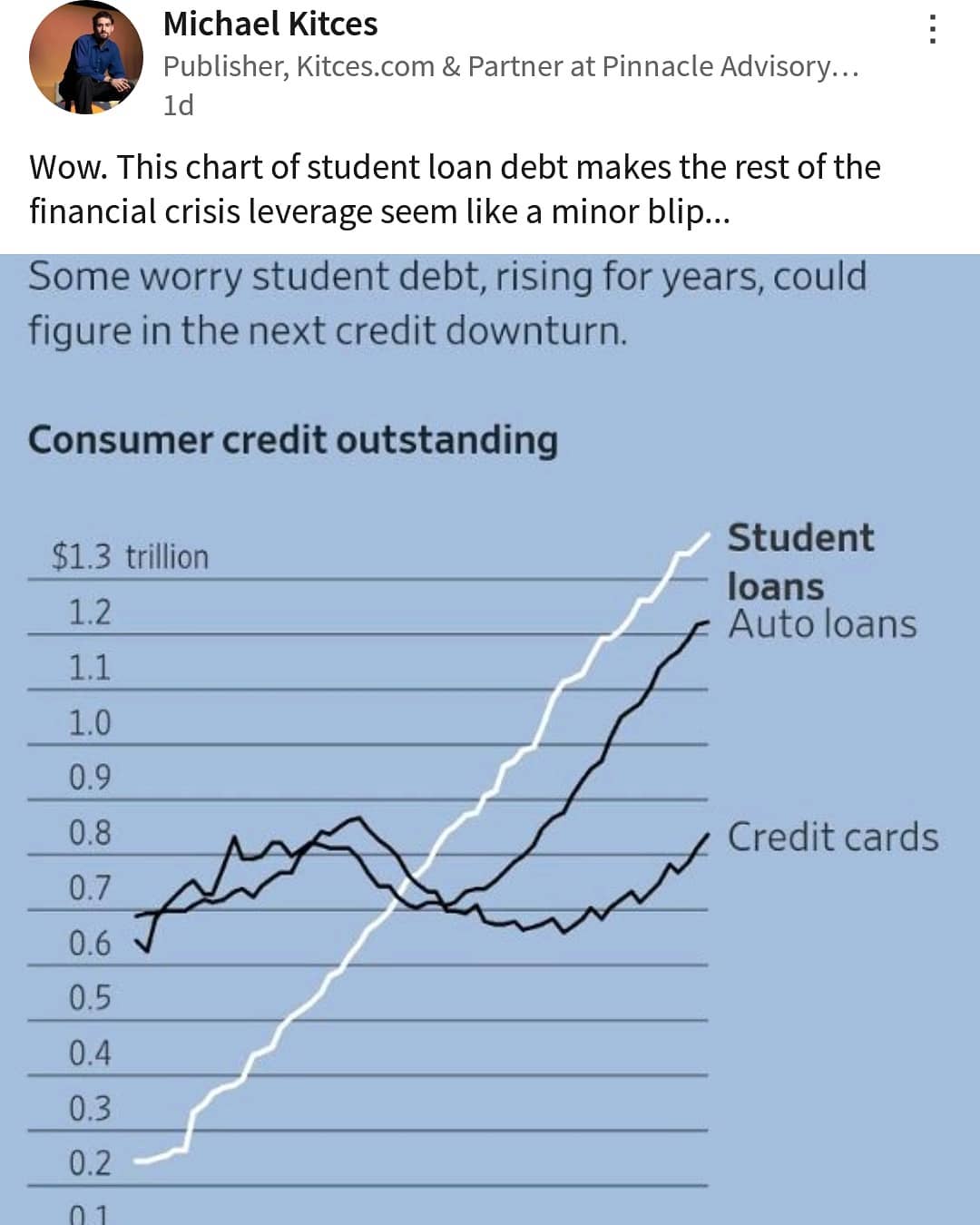

Growing Student Loan Debt in America

< 1 minute read

Eye-opening post by Michael Kitces on his LinkedIn page.

What do you know about your debt?

< 1 minute read

Do you know how much debt you have and when it will be paid off?