Some people see a tax refund as “free money” or a “bonus” while the reality is that this is your money that you have essentially been lending to the IRS as an interest-free loan.

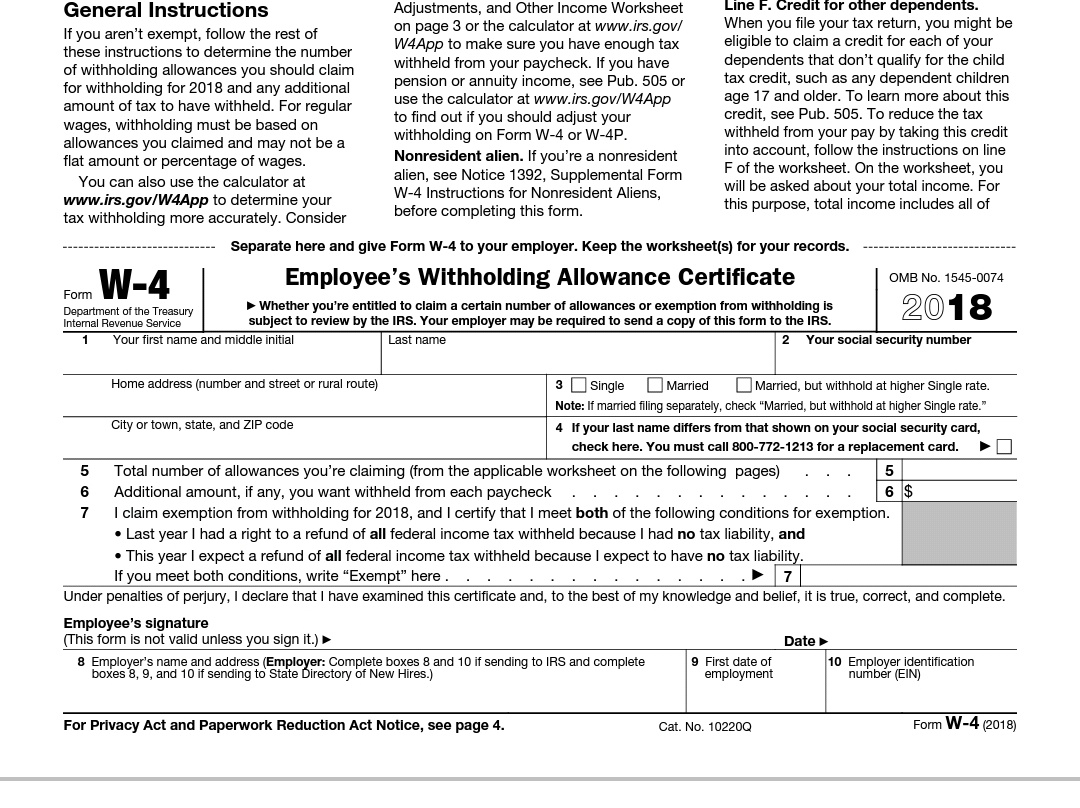

If you received a large tax refund this year, or if you owed a large amount in taxes, one thing that you can do to help get this number closer to 0 is to adjust your Form W-4 Employee’s Withholding Allowance Certificate. This may be especially prudent in 2018 due to changing Federal income tax rates and withholding tables.

Wouldn’t you rather have that money available to you throughout the year rather than have to wait until the beginning of next year to get it back? Wouldn’t you rather know that you’re adequately covering your tax burden throughout the year rather than being hit with a huge payment come filing time?

Most people probably file their W-4 when they’re hired and never revisit it again unless their tax preparer hands them a new form to give to their employer. This form tells your employer how much they should withhold from each of your paychecks to send to the IRS on your behalf to pay your income taxes.

Although certainly not optimal, I can see how there could potentially be an advantage to receiving a small refund if it helps to keep you disciplined with saving. Maybe you know that you would spend that money if you received it throughout the year but if you receive the larger refund at one time you will be more inclined to send it straight to your savings account or use it to pay down debt.

Just because you’re married and have kids doesn’t mean that you should be taking all of those allowances on your W-4. Sometimes this can actually lead to you owing more in taxes at filing time since marking allowances on the form means that your employer will withhold less of your income.

It’s best to consult your CPA or EA when considering adjusting your withholdings. If you received a large refund or still owed a large amount in taxes, then they should be proactive at helping you to adjust your withholdings anyways.