By renting rather than owning. Let me show you.

People keep asking me when I’m going to buy a home (they must not read this blog), so I wanted to dig more deeply into the numbers to see just how much I save each year by renting rather than owning.

There’s plenty of evidence that shows that a house isn’t a very good monetary investment, although the common misconception is that it is. I’ll show this in a minute.

However, a home can be a good “investment” in your family and lifestyle (notice I didn’t say for your money). It provides a place that feels stable, comfortable, and safe. For the most part, you can do what you want with and make it yours (subject to HOA rules and other laws). Some people see it as sort of a right of passage and it’s “weird” when an older person or a couple with kids rents rather than owns. In some places, there isn’t a renting market available which kind of forces buying a home.

I’ve written about this before here and here, but I’m going to go more in-depth to show how much I actually SAVE by renting rather than owning. A lot of people probably already think I’m an idiot for even saying that I can save money by renting because, “You’re throwing away money by paying rent.” That’s because those people aren’t comparing the costs correctly.

Costs of Owning in My Zip Code

Let’s see what we need to consider to actually compare ALL the costs. We’ll use the table below to compare the rent of my apartment ($935 per month) to the median home price of $212,000 in my zip code (according to Zillow). However, that wouldn’t necessarily be an accurate comparison since I only pay half of the rent ($467.50 per month) and half of the utilities.

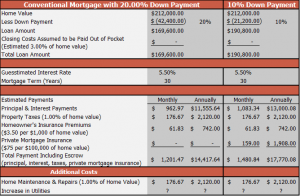

Below, we can see how much it would cost to own a median-priced home where I live. It’s much more expensive than my rent, although the home would probably be larger than my apartment:

Also, consider the costs that I haven’t factored into this scenario: coming up with the cash for a down payment as well as 2-5% of home value for closing costs, moving expenses, furniture and decorations, appliances, increased utility expenses for owning a home.

Costs of Owning a Home with a Mortgage Payment Equal to My Apartment’s Rent

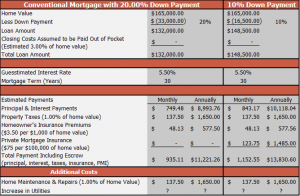

Don’t think I should compare to the median home price in my area? That’s fine. I also figured out how much I could buy a home for to make the full mortgage payment, including escrow, equal to the total rent payment of my apartment. I still come out ahead in this scenario because I don’t have maintenance costs as a renter and only pay half of the utility bills:

After 10 years under the 20% down payment scenario, you’ve made $89,937.60 in principal and interest payments and only have $23,045.68 in equity. This doesn’t even consider the costs of property taxes, homeowner’s insurance, and maintenance, which would add an estimated additional $38,775 to what you’ve spent over those 10 years. I still haven’t factored in the increased costs of paying for utilities for a home, which would likely be more expensive than an apartment.

Comparison of Renting vs Owning

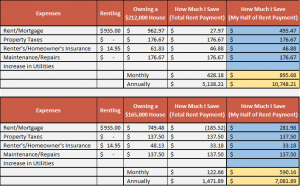

An easier way to look at this is below where I’ve shown how much I save compared to owning a $212,000 home (median home value) and compared to owning a $165,000 home versus the rent of my apartment. Since I only pay half of the rent, I’ve also compared how much I actually save (see the yellow highlighted boxes). Even if I paid the full rent each month, I’d still be ahead by renting in all presented scenarios:

Notice that these comparisons assume that the home was bought using a 20% down payment. The lower the down payment used, the more that renting is favored due to the higher mortgage payment and PMI for a down payment below 20%.

When I’ll Buy a Home

I don’t know when I’ll buy a home. For now, I’m fine with renting and being able to save for my future and have flexibility. I can email my property manager every time something goes wrong and she gets it taken care of immediately. I don’t have to do yard work or any sort of maintenance. I don’t have to worry about my home being destroyed and having to repair it or rebuild it – I’d just find another apartment. If I wanted to, I could move every year and experience living in different places until I’ve found where I’d really like to be for the long-term. But I get it; renting isn’t for everyone.

Don’t get me wrong, I’ll eventually buy a home for my family. Overall, I hope we now realize that the value of owning a home typically isn’t monetary; it’s knowing that your family has a safe place with a roof over their head where they can make memories and experience an environment of “home”.