As I’ve written before, Amanda and I love to travel and we try to do so relatively frugally. Two things that we really like to do that don’t cost much at all are to hike and to take brewery tours.

What’s The Riskiest Asset Class?

My colleague, Tim Woodward, once brought up a point to me that has stuck ever since:

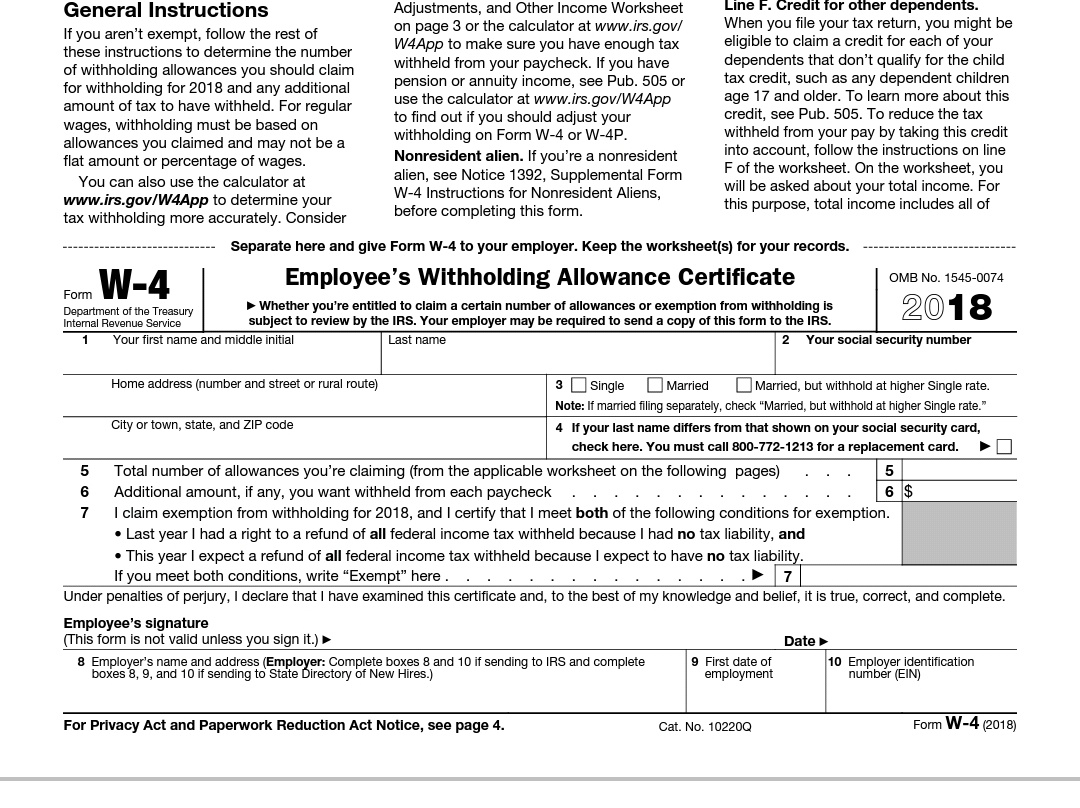

Did you receive a large tax refund (or owe a large amount of tax) in 2017?

Some people see a tax refund as “free money” or a “bonus” while the reality is that this is your money that you have essentially been lending to the IRS as an interest-free loan.

A 96-Month Car Loan?!

I was baffled when my colleague, Aaron Williams, shared this article with me that he saw on Facebook. A 96-month car loan? That’s 8 years. Think about what you were doing 8 years ago.

Be Cautious About Consolidating Student Loans

I often see articles citing student loans as one of the main reasons that young people have a hard time saving and are waiting longer to purchase homes.

Do You Have Disability Insurance?

Let’s say that you’re walking down a sidewalk on your way to your favorite store to buy a new outfit and you come across the infamous banana peel on the ground. Of course, you’re not paying too much attention to where you’re walking and you step on it, which causes you to slip and hit your head on the concrete.

Make Saving Easy

If you’re not good at saving, try making it as easy on yourself as possible.

How I Created my Financial Foundation

When I graduated college, I knew I wanted to live close to work but I didn’t have anyone to live with.

Is Buying a New Home Built Into Your Long-Term Goals?

One of the most important aspects of the job of a financial planner is to help people manage their emotions and stick to their long-term goals.

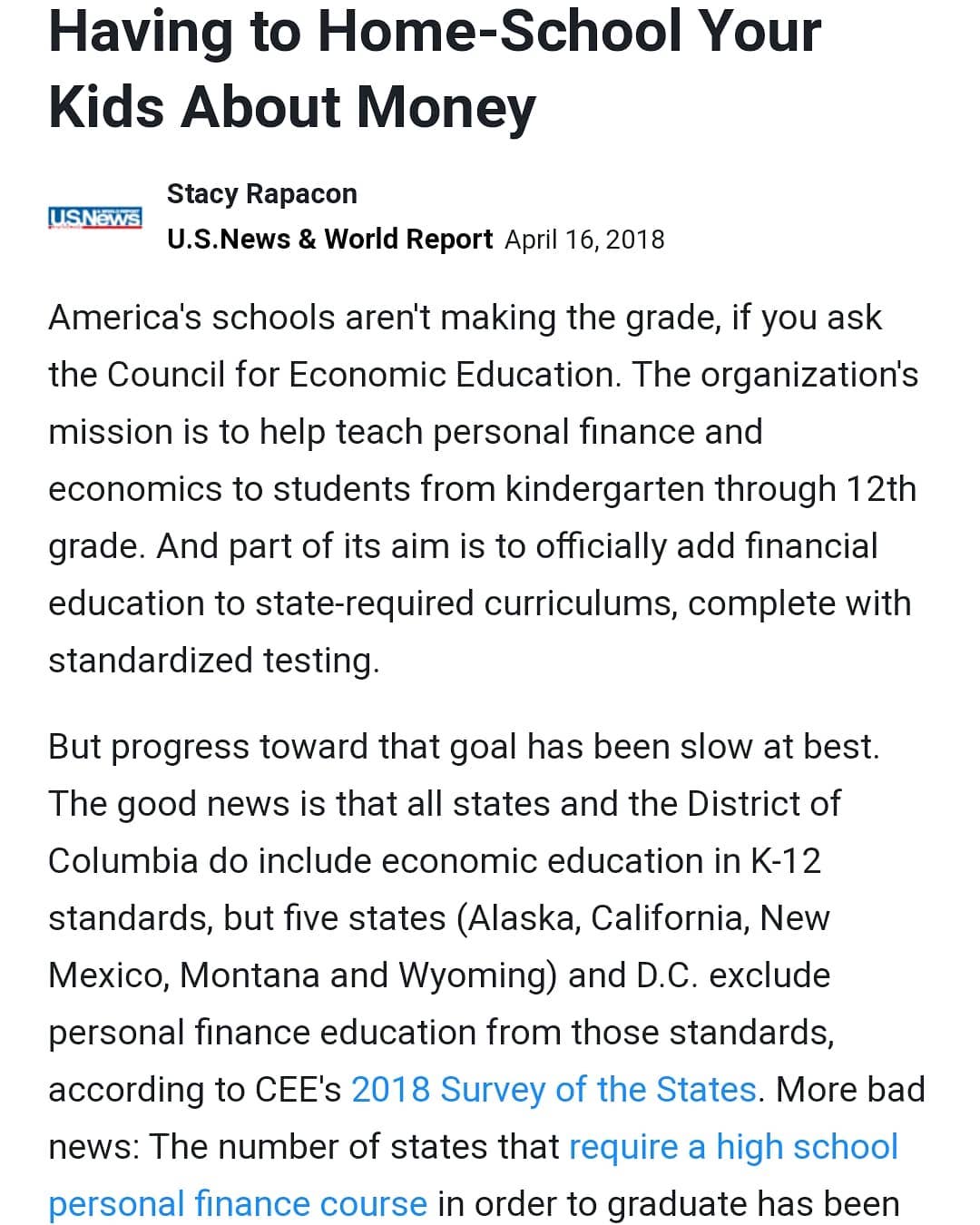

The Lack of Personal Finance Education in America

How many of us received any sort of personal finance education in high school? Not me.