If you’re in a relationship, then I’m willing to bet that one of you is more of the “money person” and one is more of the “free-spirited person”.

Drew’s Method

Break Down Goals Into Smaller Goals

I think it’s important to identify realistic financial goals and break them down into smaller goals to help ensure that you’ll accomplish what you’d like and that you will be able to adequately pay for them.

Home Purchase Considerations

Spring time is the best time to sell your home – we’ve all heard this one before, right?

Estate Planning Documents Aren’t Only for The Rich and Elderly

If something were to happen to you today, what would happen to your stuff? Who would be responsible for your kids? Who would pay your bills? Who would decide if you should receive life-sustaining support?

Get Rid of Unused Subscription Services

When is the last time that you looked at your subscription services or bills and really evaluated if you can save money? When the payments for services like these are pulled automatically from your bank account you’re less likely to evaluate the costs – out of sight out of mind. You may have forgotten that you’re paying for something that you’re not even using.

I Use a Credit Card

I use my credit card to pay for everything that I can. BUT, I pay the balance in full every month.

How will you use your bonus and/or tax return?

Many people will soon receive their annual bonus and/or tax return. What do you plan to do with your wad of cash? Save it, pay down debt, spend it?

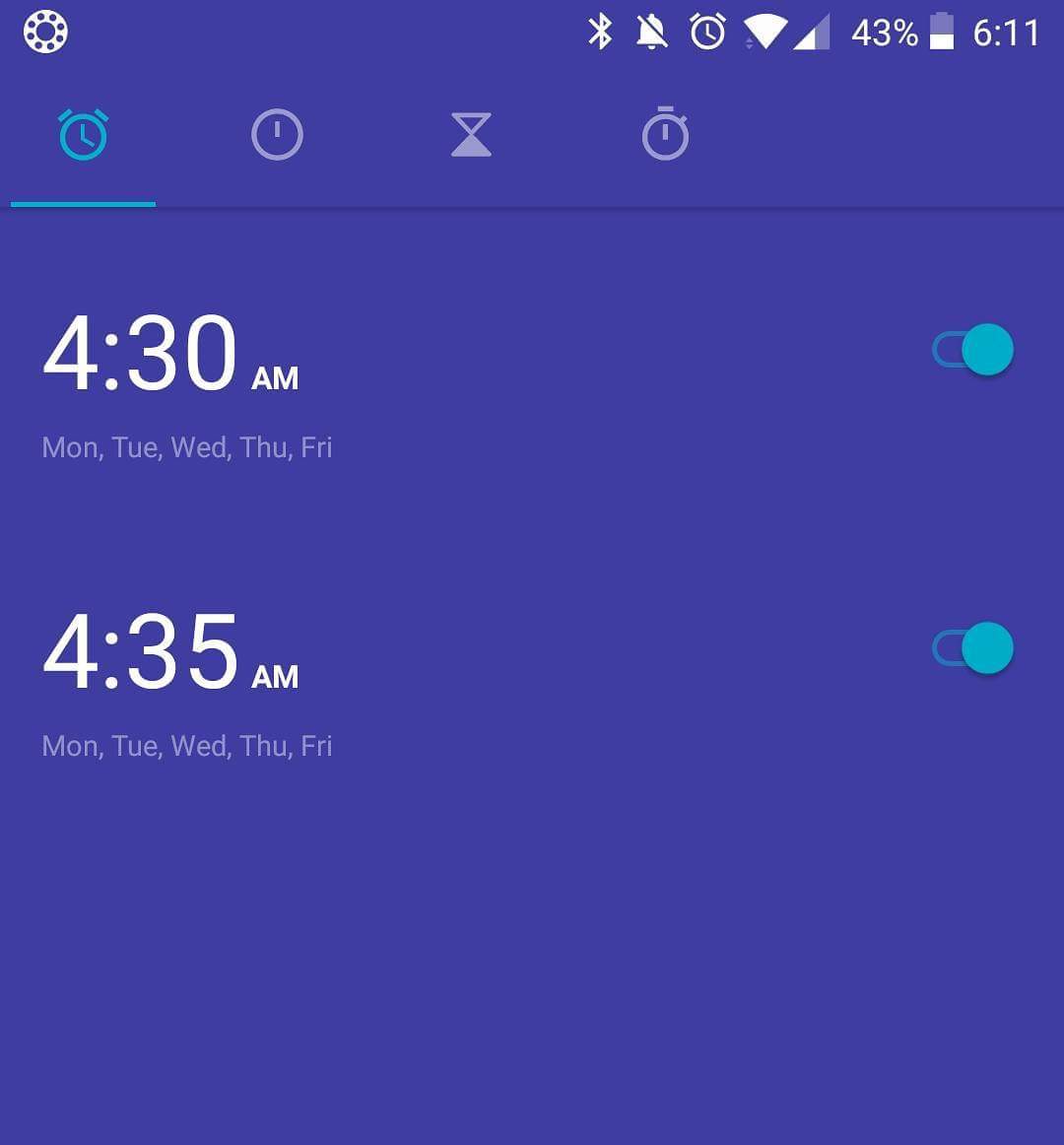

How discipline makes reaching my goals easier

A couple of weeks ago, my girlfriend, Amanda, told me that she sometimes thinks I’m a boot camp drill sergeant because she was at the gym early in the morning and I told her it was good for her.

Creating a Financial Foundation

How do you know if you have a solid financial foundation in place?