Last week, someone told me that they saw one of those billboards which shows how much the Powerball is worth and said that they had to stop and buy a ticket after seeing the amount they could win. Sadly, many believe that their only path to financial freedom is through winning the lottery (although the person who said this to me was not one of these people). However, they never stop to think what else they could do, that’s realistic, to set themselves up for a better future. Surely, they know the odds of the lottery are stacked against them (1 in 200-something million means you’re probably not going to win). After all, there wouldn’t be a lottery if there weren’t more losers than winners.

Let’s create a hypothetical situation. Let’s say that Jane Doe thinks that the odds are stacked against her and that she’ll never be able to become wealthy or be able to retire at a reasonable age without winning the lottery. (This is a common mindset among many people I grew up around.) Each week, Jane purchases $10 worth of Powerball tickets with hopes that maybe some day her numbers will be drawn. Since there are 52 weeks in a year, we conclude that Jane spends $520 per year on lottery tickets. Google and do some research and you’ll find that this is not an unrealistic assumption whatsoever.

Now, let’s assume that Jane is 65 years old and that she has spent $520 per year on lottery tickets for 40 years, since she was 25 years old. Maybe most people don’t buy $10 worth of lottery tickets every single week for 40 years, but let’s stick with it.

At age 65, Jane wants to retire but she still hasn’t won the lottery and doesn’t quite have enough in her retirement savings to do so. That’s $20,800 on lottery tickets gone ($520 per year X 40 years) with nothing to show for it.

A Different Approach

What if Jane had a different mindset when she was young and began investing $10 per week rather than using that money to buy lottery tickets? Surely, we could all find $10 per week to invest if we can find $10 per week to spend on other things such as eating out for lunch, clothes, lottery tickets, or anything else, right?

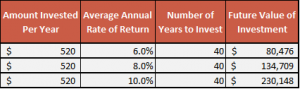

If Jane had invested that $10 per week in a mutual fund that had an average annual return of 6% over 40 years from her age 25 to age 65, then she would have $80,476 at her age 65. Compare that to $0 if she had spent that money on the lottery the whole time and never won.

If she was able to get a better rate of return of 8%, then the money would grow to $134,709. A 10% rate of return would have yielded $230,148 by her age 65 which is 11 times the cost of the lottery tickets over that same time frame.

That could provide some benefit in retirement.

The only reason to play the lottery is because you have absolutely nothing to do with a little extra money and you don’t care that you’re not likely to ever see it again, or for entertainment every now and again. There are much better things that you can do with your money to lead you towards financial freedom.

Becoming financially free is a result of the decisions that you make with your money. Play the odds in your favor.