Amanda and I love to travel but I don’t love the costs associated with paying for it. We’re very blessed that Amanda has great employment benefits which alleviate some travel costs, but we still take measures to ensure that we don’t spend more than we have to.

Budget

Don’t Let a Home Become a Financial Burden

Now is a time of the year that a lot of people are buying houses or at least considering it. Don’t let that become a decision that you regret.

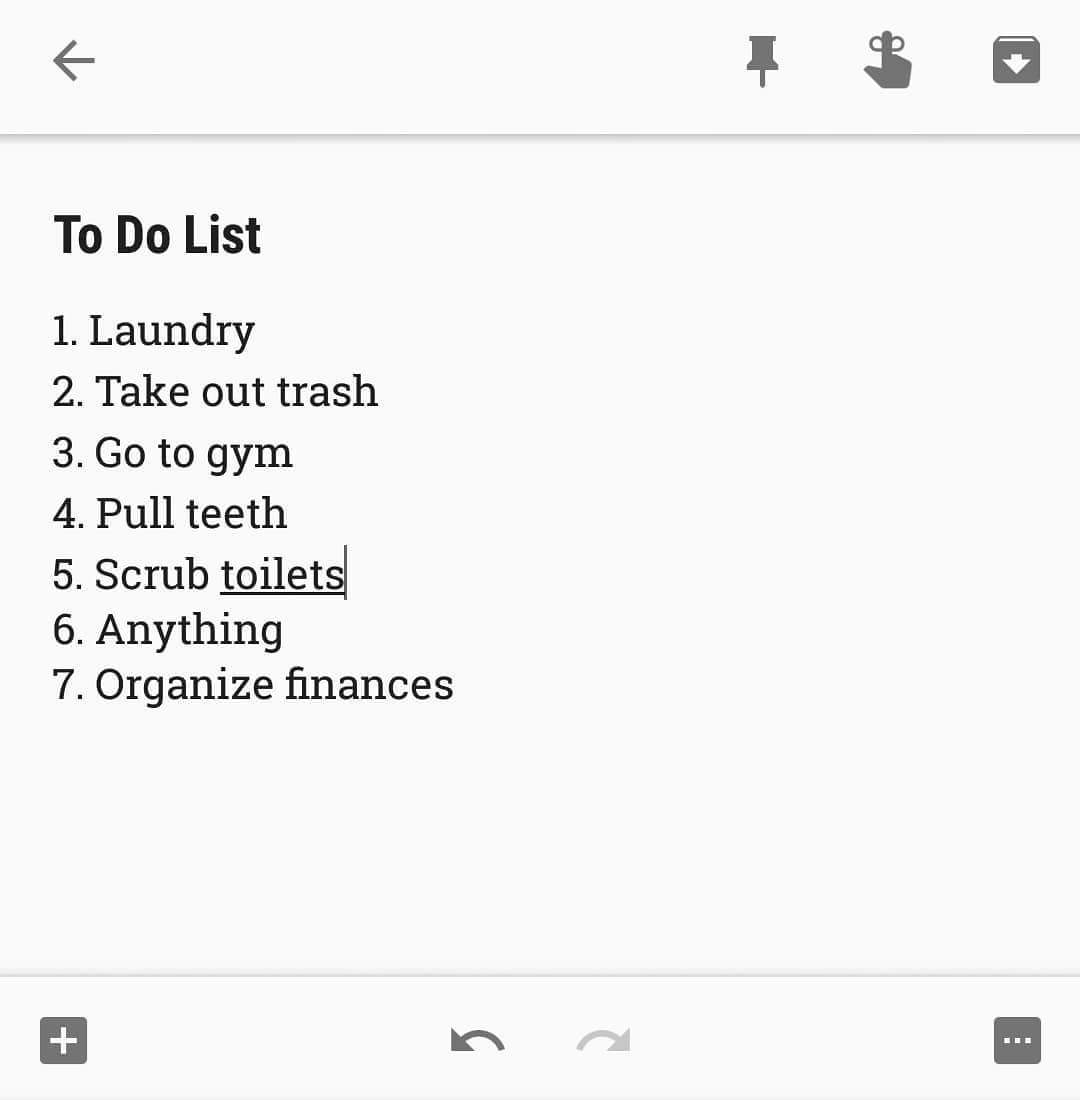

Personal Finance Isn’t a To Do List

We all procrastinate sometimes – doing laundry, taking out the trash, going to the gym, handling personal finances.

Break Down Goals Into Smaller Goals

I think it’s important to identify realistic financial goals and break them down into smaller goals to help ensure that you’ll accomplish what you’d like and that you will be able to adequately pay for them.

Get Rid of Unused Subscription Services

When is the last time that you looked at your subscription services or bills and really evaluated if you can save money? When the payments for services like these are pulled automatically from your bank account you’re less likely to evaluate the costs – out of sight out of mind. You may have forgotten that you’re paying for something that you’re not even using.

I Use a Credit Card

I use my credit card to pay for everything that I can. BUT, I pay the balance in full every month.

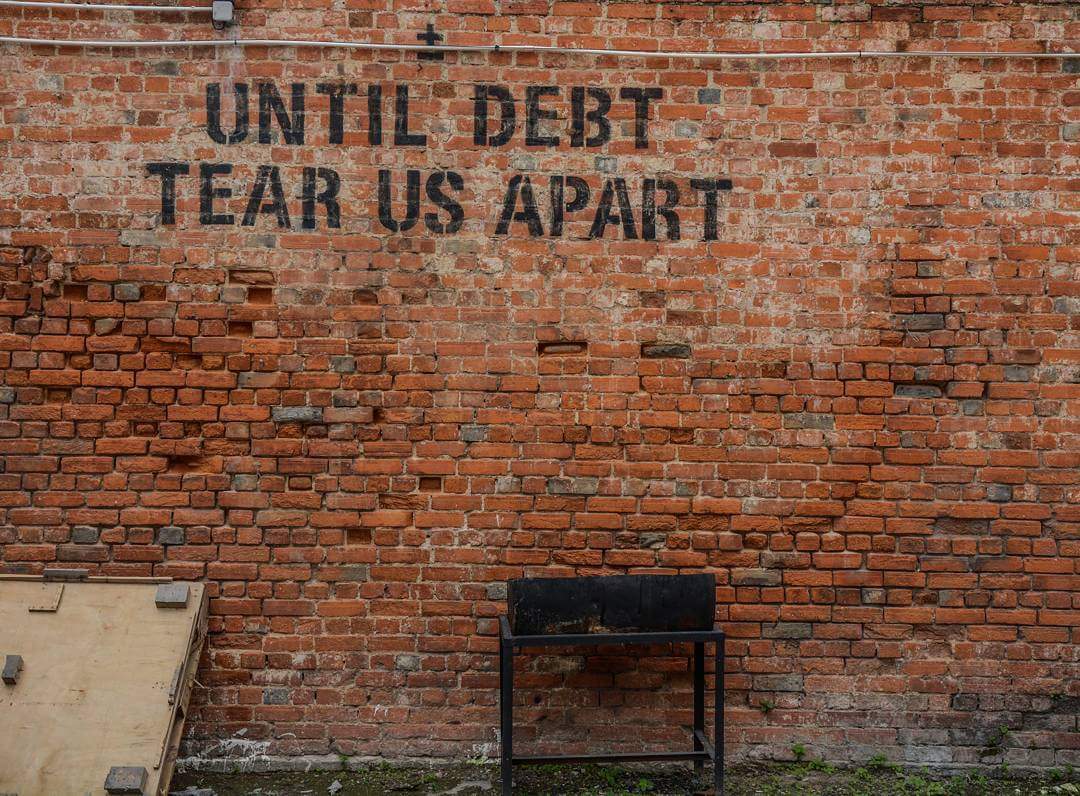

What do you know about your debt?

Do you know how much debt you have and when it will be paid off?

Keeping up with the Joneses

Remember the commercial where the guy talks about how great his life is with his nice 4-bedroom house, his new car, and his country club membership?