Over the weekend I spoke to a friend who graduated from physical therapy school earlier this year. He didn’t have any help with school expenses and graduated with $160,000 in student loans. To his benefit, he’s pretty frugal and has a good natural sense about money. However, $160,000 is a really big number and it has him worried. He’s been asking himself if he’s going to be able to be okay with that amount of debt and whether the right decision is to pay down the debt as quickly as possible or if he should save for retirement as well.

Student Loans

Federal Student Loan Payment Pause Extended Through January 31, 2022

Federal student loan payments have been paused since March 2020. As of August 6, that pause has been extended “one final time” through January 31, 2022. What this means is that Federal student loan payments will not be required until February 2022 and that interest on these loans will not accrue during that time.

Should I Refinance My Student Loans?

Similar to mortgage interest rates, student loan interest rates have been dropping this year. That decrease in rates, along with the pause in payments and interest accrual under the CARES Act, has led many to wonder whether they should be doing something with their student loans. One of those options is whether or not to refinance them.

Back to School: Student Loan Edition

Last week, Amanda was faced with a significant financial decision that millions of others have had to face as well without ever having any education or guidance on what they should do: take out student loans for the next year of college or figure out how to pay for it out-of-pocket? From the perspective of a financial planner, this process was completely not transparent. Luckily, Amanda knows a guy.

Student Loan Deferment

The college class of 2019 has graduated and now is off to the real world. Many of these former students have loads of student debt that most of them aren’t contemplating how to deal with yet. Undoubtedly, most of these graduates will also elect to take the 6-month allowable deferment (grace period) on Federal Stafford student loan payments and (pretend to) forget about them until judgement day comes in the form of a bill.

4 Ways to Save for Your Child’s College Education

4 minute read

Before you ever consider paying for your child’s college education, you need to first make sure that you’re taking care of your own financial situation. This is sometimes an unpopular opinion among parents, but one that’s very popular among financial planners. I get it, they’re your pride and joy and you want what’s best for them. But sometimes you have to think about yourself first.

We all know about how student loans are affecting the finances of younger generations, but there will be resources (yes, including student loans) available to your children to help them pay for college. On the other hand, if you’re forced to quit working due to a disability or health problem, or you reach the age that you’d like to retire, there’s not much that you can do if you spent the money that you need to retire on putting your children through college.

Placing paying for your child’s college education above your own financial situation could lead to you not reaching your own goals and having to sacrifice later in life, or potentially even work longer than desired.

I don’t think that everyone needs to (or should) go to college, but I’m sure a lot of people will still attend college in the future and many jobs will require it. What if you save a hefty amount for your child’s college education and they don’t go to college, though? What if they receive a scholarship? Where should you save for college (if you’ve already made sure that you’re taking care of your future self) anyways?

If you’ve taken care of yourself, and you have the capacity to do so, here are 4 options to save for college education:

529 Savings Plan

A 529 plan is a tax-advantaged education savings plan in which you can invest money. Investments within a 529 grow tax-deferred and the money can be pulled out tax-free, if used for qualified education expenses. The money that you save within a 529 can be used for qualified education expenses at colleges and universities, vocational and technical schools, and even primary and secondary education, as of 2018. (Note: Refer to the rules of the 529 plan that you use for specific guidance on what is considered a qualified education expense and what institutions qualify).

In Indiana, contributing up to $5,000 to a 529 plan will provide you with a 20% state tax credit, up to a maximum credit of $1,000 ($5,000 x 20%). That’s a pretty good incentive, but what if you save into the account and your child doesn’t go to college? You can change the beneficiary of the account to another eligible family member, pull out the money and pay the taxes due plus a 10% penalty, or wait and save it for later. If your child receives a scholarship, then you can pull out funds up to the amount of the scholarship penalty free, but you’ll still be responsible for paying the taxes on the earnings.

529 plan contribution limits are very high (up to $450,000 per beneficiary in Indiana) and vary by state. However, a contribution over $15,000 in 2018 ($30,000 for married couples) could cause gift tax consequences. Still, you’re able to make a lump-sum contribution of 5 years’ worth of contributions ($150,000 for married couples) in one year and avoid any potential gift tax consequences.

Roth IRA

If you don’t want to have to worry about your child not going to college and how you would deal with the money in a 529, then you could use a Roth IRA as a pseudo college savings account. However, there are a few potential limitations to using a Roth in this manner.

First, you would end up pulling money from a retirement savings account with great tax advantages that you may want to keep for retirement. Secondly, those under age 50 can only contribute $5,500 to a Roth IRA in 2018 ($6,000 in 2019). Those over age 50 have an additional catch-up contribution of $1,000 for a total contribution of $6,500 in 2018 and $7,000 in 2019. You must have earned income of these amounts to be eligible to contribute them to the account.

Additionally, there are income phase-out limits to contributing to a Roth. In 2019, those who earn $193,000 or less and file their taxes as married filing jointly ($122,000 for those who file as single) can contribute up to the limit. However, those who earn more than $193,000 ($122,000 for single) begin to be phased out of making contributions and those who earn $203,000 ($137,000 for single) or more are not eligible to contribute to a Roth.

The positive side of contributing potential college savings to a Roth is that you can pull out contributions (not earnings) from a Roth IRA to pay for qualified college education expenses without penalty or being taxed, if you’re under age 59 ½. If you’re over age 59 ½, and have had a Roth open for 5 years, then you can pull out contributions and earnings tax and penalty free. If your child doesn’t go to college, then you just keep the money in the account for your retirement or to pass on to your heirs.

Taxable Account

You could simply save into a checking or savings account for your child’s college education. However, you run the risk of your money losing purchasing power to inflation. Alternatively, you could open a brokerage account and choose an investment allocation for the money. This would be similar to saving to a Roth in that you could keep the money in the account and use it for retirement if your child does not attend college. However, if they do attend college, then you would be taxed on any gains that you recognize when selling securities to raise cash to pay for college education expenses.

Cash Flow

If you have, or believe that you will have, a significant enough income that will allow you to continue to save, reach your goals, and also pay for your child’s college education, then you may be able to cash flow the expense once the time comes.

There are multiple strategies for saving for college education expenses, including combining those strategies mentioned above, but there isn’t a one size fits all approach. One thing that is very important to keep in mind is that you need to take care of yourself before worrying about paying for your child’s college educations.

Avenues will be available for them to pay for college, but you can’t go back and press redo on saving for retirement.

The Potential Hidden Cost of Student Loan Forgiveness

2 minute read

PSLF is available to those who work in government or not-for-profit and make 120 consecutive qualifying monthly payments towards their student loans. There are a lot of details around this, but those are for another day. Check the PSLF link above if you’re interested in learning more. To be eligible, an individual must complete the PSLF Employment Certification Form for each year that they worked for an eligible employer and made eligible payments. If all of the requirement are satisfied, then any remaining federal student loan balances will be forgiven.

Income-driven repayment plans tie your student loan payments to your income. If you fulfill all of the requirements, including recertifying annually, then any remaining federal student loan amount at the end of 20-25 years (depending on payment plan) will be discharged.

Keep in mind that these programs are for Federal student loans. You’ll likely end up being responsible for paying all of your private student loans yourself, even if you work for the government or a nonprofit.

Currently, any loans that are forgiven under PSLF are not treated as taxable income. However, loans discharged under the income-driven repayment plan options after 20-25 years of payment are treated as taxable income in the year that they’re forgiven. This is something to be aware of since laws always change and there has been some discussion about this topic recently.

For example, if someone had $100,000 of student loans forgiven under PSLF, then they would not have to pay any taxes on that amount. However, if someone were in the 24% tax bracket and had $100,000 of student loans discharged under a repayment plan, then they could have an extra $24,000 of taxes to pay in that year.

Before using these programs, you should run the numbers to see if it’s worth utilizing them. You could actually end up paying more in payments and taxes than if you were to just pay the loans off more quickly.

What’s the Best Way to Pay Off Debt?

3 minute read

The answer is complicated and based on your own personal situation and comprehensive, long-term financial plan.

Mathematically Optimal – Highest Interest Rate

Mathematically, the most optimal option would be to pay down the highest interest rate debt first, which is the option that I opted for. For example, if you have a student loan with a 6% interest rate and you decide to make extra payments towards the principal to pay it down faster you are “guaranteeing” a return of 6%. The reason we can look at it as a “guaranteed” return is that you’re going to have to pay the debt off (unless you declare bankruptcy) no matter what. By paying down the principal balance of the debt more quickly you are ensuring that you won’t have to pay as much of that 6% interest rate over the life of the loan.

However, this wouldn’t be the most mathematically optimal option if you believed that you could take those extra payments that are going towards your debt and invest them in the market at a higher rate of return than the interest rate on your debt. Obviously, you would be trading a sure thing (the interest rate of the debt) for an unsure thing (the return of your money in the market) in this case. Depending on interest rates and expected rates of return, this may be an option for some people who have a higher risk tolerance and are able to take a long-term view of the markets and their financial situation.

Emotionally Optimal – Lowest Balance (Debt Snowball)

Sometimes, the emotionally optimal answer is paying off your lowest debt balances first utilizing a Debt Snowball approach, a term made famous by Dave Ramsey. Remember that under both the mathematically optimal and the emotionally optimal approach you are continuing to make minimum payments on all of your obligations.

Utilizing a Debt Snowball method may be better for some people because it allows them to recognize small wins along the way and continue to build motivation to better their situation. While continuing to make minimum payments on all of your debts, you would apply any extra money to the smallest balance loan until it’s paid off. Once the smallest loan is paid off, you would then apply the payment that you were making towards that loan to your next smallest loan balance.

As you continue to pay off debts, you continue to “snowball” your payments into the next largest debt. You may have only been able to pay $50 per month towards the first loan that you were paying off, but by the time you have paid off loans 1 and 2 and are focusing on paying off loan number 3 you may now have $150 extra per month to apply towards it.

The way that you tackle your debt is a largely personal decision. The best option is the one that will be sustainable for you in the long run and which provides you with the greatest peace of mind.

Be Cautious About Consolidating Student Loans

< 1 minute read

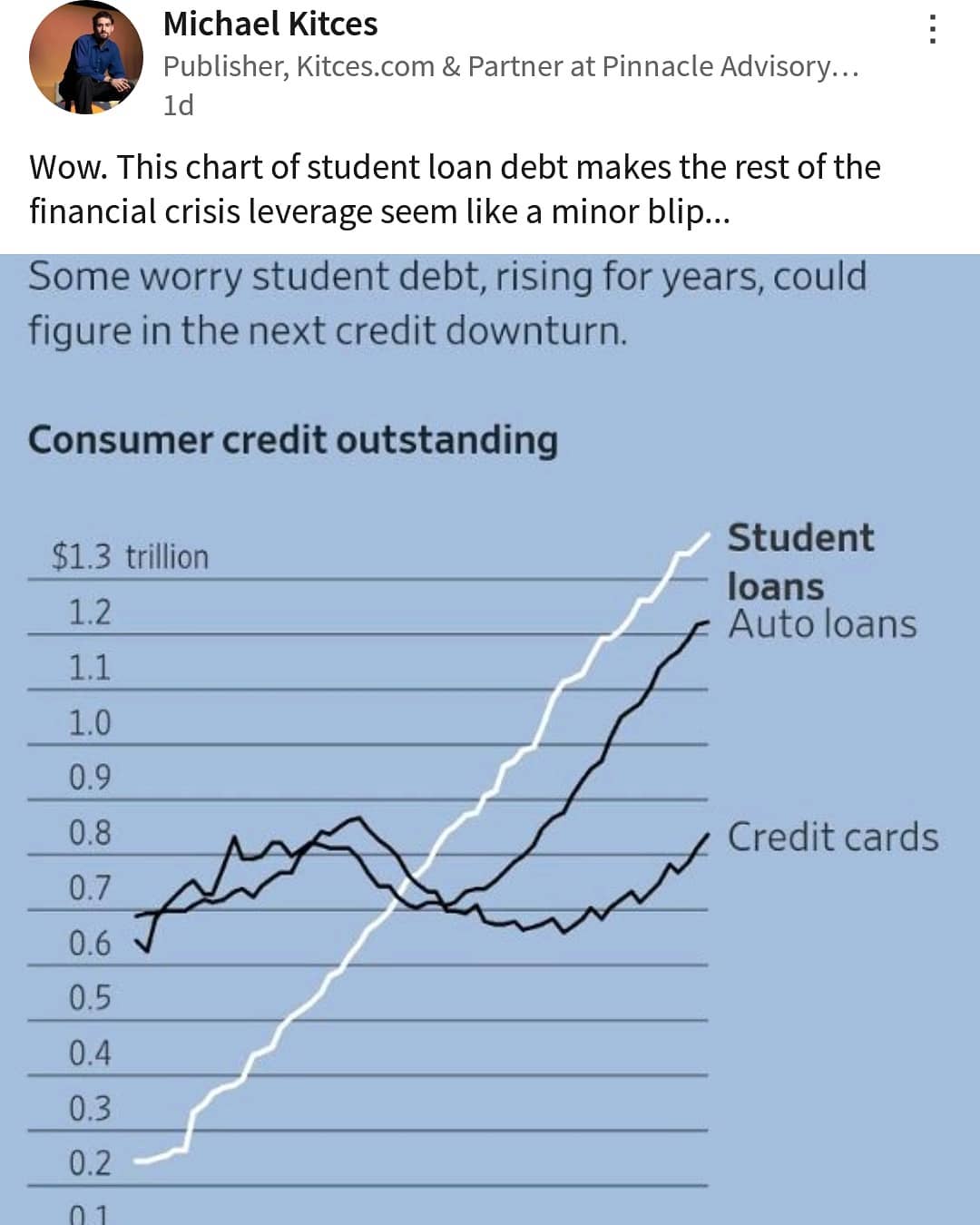

College costs have inflated around twice as much as general inflation and the average college graduate has around $30,000 – $40,000 in student loan debt.

According to the Federal Reserve, Americans have about $1.5 trillion in outstanding student loan debt, which exceeds outstanding credit card debt at $1.0 trillion, and faces an increasing delinquency rate.

Some people may be inclined to want to consolidate these loans to help with their cash flow, but this can be a tricky situation:

- There’s a difference between consolidating and refinancing.

- Refinancing Federal student loans into a private loan can mean losing benefits that Federal loans have such as repayment plans and loan forgiveness.

- Consolidation likely means that you’ll be increasing your repayment period to help with decreasing the monthly payment, which could end up meaning that you pay more in interest in the long run. I can’t imagine continuing to pay towards student loans 20 years after I graduated. That’s longer than some mortgages!

- Consolidation can also lead to the loss of some Federal loan benefits.

- Some of the loans that you consolidate may have actually been at lower interest rates before the consolidation.

Growing Student Loan Debt in America

< 1 minute read

Student loan debt is growing rapidly in our country and there are really only three ways to get rid of it: pay it off, have it forgiven through a government program (you’ll owe income taxes on the amount forgiven), or die.

Historically, student loan debt has not been forgiven in bankruptcy and there isn’t any asset backing it that you can give to the lender for them to forgive the loan.