Last week and this week are full of me “giving back” to the community. Last Thursday, I attended an Indiana State University Financial Planning Advisory Board meeting where we answered students’ questions and had lunch with some of them, this Thursday I will be at Eminence Elementary School for 4th & 5th Grade Career Day where I believe other middle school and high school teachers may be expecting me to speak to their classes as well, and on Friday I will be participating in Student Day with the Financial Planning Association of Greater Indiana. I have a hard time calling these types of things “giving back”, but that’s what others call them so I’ll stick with it.

Looking Rich

Do you think that you look rich? Do you think that the person who drives a brand-new car looks rich? What about the person who lives in the most expensive house in their neighborhood? Just because someone “looks” rich doesn’t mean that they are. In fact, someone who “looks rich” because of the car that they drive, the house that they own, or the vacations that they take is probably actually not wealthy.

Hire A Pro

As I mentioned in my last post, I recently moved to a new apartment and it pretty much took a whole day. This reaffirmed that moving may be the thing that I hate most in the world. It’s just a cumbersome process from packing to cleaning to loading everything up to driving to unloading everything to unpacking and on and on and on. I thought that Amanda and I didn’t have much stuff until we started packing and loading everything. And I’m still pretty sure that we have less stuff than a lot of people our age, which is scary to me. There was so. Much. Stuff. We ended up taking two truck-loads to Goodwill and countless other bags to the dumpster and still had a ton left over to move.

Pay Up

I moved to a different apartment over the weekend and between everything that comes up during the moving process I was reminded of a money-saving lesson: Sometimes paying a large sum up-front can save you money in the long-run.

IRA

Since I wrote about 401(k)s earlier this week, I figured I’d write about IRAs today. Not everyone has a job that provides an employer-sponsored retirement plan such as a 401(k). When this is the case, an IRA can often be a good alternative to start with to save for retirement.

401(k)

The other day, someone asked me how I feel about 401(k)s. They told me that they weren’t sure about them and that they wanted to invest riskier but they hate not being able to touch it for so many years.

A First-Time Home Buying Experience

As I started writing my last post on whether or not you should buy a home, I thought it would be cool to ask my friends Austin and Jackie to “guest write” about an experience that they’re currently going through of buying their first home. I knew that they are people who have done the right things to successfully position themselves financially to make their first home purchase. I also knew that they are people who have thought through all aspects of buying a home rather than continuing to rent, instead of just buying a home because someone told them it’s what they should do. I don’t want to put too many words in Austin’s and Jackie’s mouths, so here’s what they had to say…

Should I Buy A Home?

7 minute read

I’m a skeptical person and I prefer to research and make decisions for myself rather than do what society tells me I should do. When it comes to purchasing a home and “living the American dream”, I believe that too many allow society to dictate their actions rather than actually taking the time to think through such a significant decision themselves. I prefer to let research and math dictate most of my financial decisions, but this is a subject that most people have a hard time letting go of their emotions to think through.

Most people who own their home love it and the lifestyle that it provides and they simply cannot fathom that owning a home may not be the most financially optimal thing that they could do with their money due to that emotional attachment. Below, you’ll find some of the research that I’ve found both for and against owning a home.

Lifestyle Decision Vs Financial Decision

Buying a home is usually more of a lifestyle decision than a positive financial decision, when you consider all factors involved and the alternatives available to you. There are a lot more factors to consider when evaluating the decision that most people don’t take into consideration, but my research shows me that purchasing a home is not the most optimal thing that I can do with my money in my situation.

However, most people probably wouldn’t take advantage of what’s most optimal anyways and would rather opt for something they feel more comfortable with. I’m not saying that I’ll never buy a home, I will at some point, but I’m trying to do what is the most optimal for my money right now so that I’ll have greater financial flexibility in the future.

Why Buying A Home May Not Be The Best Financial Decision

I wrote about this last year and received a lot of feedback from people trying to tell me that I was wrong. However, most of those people weren’t considering all of the points that I’ve researched and none provided any numerical data to back up their claims. On the other hand, I also received quite a bit of feedback from those who own homes and agreed with the facts that I presented and my point of view but were not willing to rent due to the lifestyle that owning a home provides them.

“You’re throwing money away by renting.”

Alright, maybe I am. But you’re throwing money away by paying closing costs, interest, PMI if you have it, homeowner’s insurance, property taxes, HOA fees, and maintenance and repairs on a home. That’s all money that you’re paying just so that you can make some principal payments towards your mortgage.

Simply comparing the cost of rent to the cost of a mortgage isn’t accurate – you don’t have these additional expenses listed above when renting. Depending on your interest rate, the majority of your mortgage payment may be going towards paying interest for over half of the life of the loan before you ever turn the corner to where the majority of your payment is going towards paying down your principal balance. That’s a lot of money to be “throwing away” that’s not going towards making your personal finances better.

Don’t underestimate home maintenance and repairs. You never know when unexpected expenses will come up that you have to pay for when owning a home – bursting water pipes, a new roof, new water heater, HVAC repairs or replacement, replacing appliances, flooding, termites, mold, renovations, upgrades, routine maintenance etc. It all adds up and may not be as predictable as you’d like to think. If you’re not properly insured some of these could be huge out-of-pocket expenses. Even if you do have the perfect insurance in place, most of these things won’t be covered.

You may say that you’ll build equity by owning a home, but that may not be the best argument given the amount of time that most people own a home. Most people don’t stay in the home for very long and each time you move you have to pay realtor fees to sell your home, closing costs to purchase your new home, and potentially moving fees. Then, you’re going to be starting back over at the beginning of a mortgage where most of your payments are going towards interest.

Additionally, you’re going to be more likely to want to continue to make improvements to your home, especially as your income increases. Some improvements can be very costly while not actually increasing the value of your home. That could be money that you spend and never see again.

“But I can pay more on my mortgage”

True, you can, but the question of whether you should do so or not depends on the interest rate on your mortgage and your expected rate of return by investing that extra money instead. Would you be better off by investing your money at a compounded rate in the market or paying extra towards your mortgage at an amortized rate? As with most things in personal finance, the answer depends and could be different depending on whether you want to take the mathematically optimal approach, the emotionally optimal approach for you, or a hybrid.

“But home prices appreciate.”

Do you know how much home prices appreciate? Historically, in the United States, home prices have appreciated at about the same rate as inflation. In real terms (home price appreciation % minus inflation %), this means that you haven’t made any money through the appreciation of your home. Keep in mind, regional date could be much different and there are places where home appreciation has outpaced inflation.

Even if your home price has outpaced inflation, it doesn’t really do you much good unless you sell your home and get the money out of it or you pay to refinance/pull the equity out of your home. If you’re refinancing to use the equity out of your home, then you’re going to be paying interest again to use that money.

If you took all of those extra expenses that you’d otherwise have to spend to own a home and invested them in the market, which has significantly outperformed the appreciation of home prices historically, then history tells you that you’d end up ahead. The problem with this is that most people aren’t disciplined enough to “invest the rest”.

Depending on how much you plan to use as a down payment on the home, you could be losing out on quite a bit of returns by having that money in cash until you have reach a significant down payment rather than investing it in the market. Even if you were to calculate the rate of appreciation on your home, you’d still need to back out ALL of the money that you’ve put into it, including ongoing repairs and maintenance, to get to an accurate number of how much it has appreciated on a % basis.

“I own my home outright.”

If you’ve been diligent enough to pay off your home and you can say that you own it outright, that’s amazing! You’re in the minority. But, take a minute to think about what that does for you financially. As I mentioned above, in order to have access to the equity in your home you have to either sell it and incur the transaction costs of doing so or you have to use a financial instrument such as a home equity line of credit or a reverse mortgage to have access to that wealth. With a home equity line of credit or a reverse mortgage you’re going to be limited to the amount of equity that the financial institution will allow you to use.

You Aren’t Prepared

Most people don’t have a properly funded emergency fund in place or a significant down payment to put down on a home purchase. You want to have a cash reserve of 3-6 months of expenses in addition to a down payment before considering purchasing a home. You also want to make sure that you’re purchasing a home that you can actually afford and that you’re ready for the extra responsibility and potential unforeseen expenses that come along with homeownership.

Concentration Risk

As a financial planner, I’m expected to preach diversification to my clients. If someone has all of their money in one stock and something happens to the company, there’s the potential for the client to lose all of their wealth. Many people are in a similar situation with their home in that it holds the majority of their wealth.

If a home is not properly insured, or a homeowner doesn’t have a cash reserve in place, a disaster could mean a total, or near total, loss of wealth. Yes, the value of the land will still be there, but the home price for most people is probably worth more than the land alone. Many people live in a situation where their hopes for a positive financial future would be gone if their home were destroyed. Even if your home weren’t destroyed, you probably only own a house in one place. If that place experienced a significant housing market decline, your net worth would significantly decline along with it. It’s important to diversify your net worth outside of your home.

The Argument For Buying A Home

There are arguments for buying a home, but I don’t believe that there are many financially viable arguments for doing so in most situations. (Notice I said “most”.) One such point that could be made is that most people wouldn’t follow the plan I’ve set out above of investing the money that they would otherwise have to pay towards additional expenses to own and maintain a home.

Forced Savings

Yes, paying a mortgage is almost like forced savings, but remember that the majority of your payment is likely going towards interest on a 30-year mortgage for quite a while. Additionally, when most of your net worth is tied up in the equity in your home you can’t use it without selling or using another financial instrument that is going to cost you money.

Emotional Investment

Buying a home is a much better emotional investment for most people than it is a financial investment, given the available alternatives. Some people love completing house projects, working in the yard, and maintaining a home and making improvements without having to ask permission. They enjoy being able to come home from work to a house that they love and that they don’t have to follow rules in set by a landlord. I believe that the emotional aspect of owning a home is the most viable argument and one that I would concede with much more readily than a financial argument for doing so.

First Time Home Buying Process

Not everyone is willing to live the renting lifestyle, even in a standalone home, and I understand that. Some people want a place that they can call their own and that they can personalize without having to answer to anyone else. I’ve asked one of my friends who has recently purchased a home to write a post about his experience of buying his first home. Be on the lookout for his article at the end of this week.

Additional home purchase consideration resources:

- Episode #100: Elroy Dimson, “High Valuations Don’t Necessarily Mean That We’re Going to See Asset Prices Collapse” – Meb Faber, Meb Faber Research Stock Market & Investing Blog

- I’m a financial planner — here’s why I won’t buy a home – Eric Roberge, Business Insider

- Why your home is a worse investment than you think – Ken Fisher, USA Today

- I hear you, but your home is still a lousy investment – Ken Fisher, USA Today

- Point/Counterpoint on Real Estate as an Investment Option – Ben Carlson, A Wealth of Common Sense

- The true cost of homeownership is higher than you think – Wealthy Nickel

- How Much House Equity Are You REALLY Building? – Eric Roberge, Beyond Your Hammock

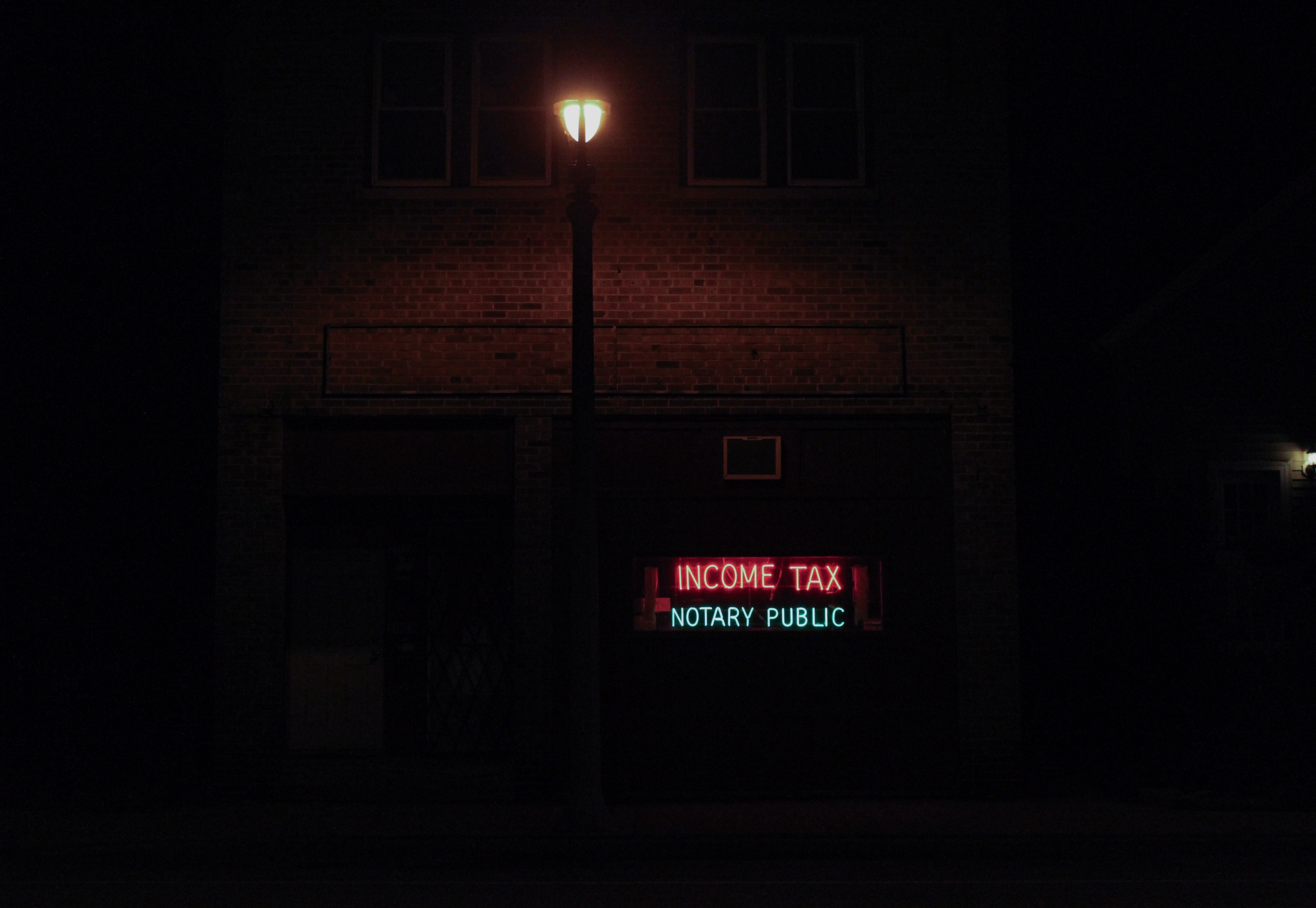

Tips To Lower Your 2019 Taxable Income

3 minute read

Save To Tax-Advantaged Accounts

There are many options for you when it comes to saving that will help you to decrease your taxable income. Contributing money to an employer provided retirement account such as a 401(k) or 403(b), saving to an IRA, or contributing to a Health Savings Account (HSA) are all ways to decrease your taxable income, which in turn will decrease the amount of taxes that you’ll have to pay. An even bigger benefit to saving to these accounts is that you’ll be helping your future self prepare for retirement and/or large medical expenses.

Another option is to save to a 529 College Savings Plan. Indiana residents who file taxes in Indiana receive a 20% tax credit on up to $5,000 in contributions to Indiana CollegeChoice 529 Savings Plans. That’s up to a credit of $1,000 taken directly off your tax bill ($5,000 contribution x 20% credit). Tax credits are better than tax deductions because they reduce your tax bill dollar-for-dollar whereas deductions only marginally reduce the amount of taxes that you pay.

Maximize Your Employee Benefits

Besides making contributions to your employer retirement account, there are often other employee benefits that employers provide that you can take advantage of to reduce your taxable income. Some of the best, but often overlooked, benefits that you may have available to you are the dependent care FSA and the HSA, which I mentioned above.

An HSA will not only allow you to save on Federal taxes, but you also do not pay FICA (Social Security & Medicare) taxes on money that you contribute to the account, if the contributions are setup through your employer’s payroll system. (if you make contributions directly, then you’ll still have to pay FICA taxes on that money).

If you’re paying for daycare or before/after school care for your kids, then contributing to a dependent care FSA is a no-brainer. You’re already paying for the care for your child and using the dependent care FSA allows you to do so in a tax-free manner, up to a limit. You should be taking advantage of this benefit if it’s available to you and you’re currently paying for dependent care expenses.

File A New W-4

A W-4 is a the Employee’s Withholding Allowance Certificate that you file with your employer (you probably did this when you first began working there). This document tells your employer (or more likely your employer’s payroll company) how much to withhold from your paycheck for taxes.

If you owed a significant amount in taxes this year, or even if you’re getting a hefty refund, you may want to consider filing a new W-4 with your employer to have a more appropriate amount withheld from your paycheck. This can help to make sure that you don’t end up in the same situation come tax time next year. While updating your withholdings through filing a new W-4 doesn’t decrease your taxes, it can help to make things easier when it comes time to file next year – making sure that there’s not a large balance due when you file or making sure that you keep more money in your pocket throughout the year and receive a smaller refund.

Start Saving On Taxes Now

Articles about how to save money on taxes are usually written towards the end of the year when people begin to think about how much they will owe and start trying to figure out if there are any last minute things they can do to decrease their taxes. Being proactive and starting to implement some of these strategies now will help you make sure that you’re able to relax while everyone else is searching for end-of-year tax savings tips.

2019 Financial Spring Cleaning

4 minute read

I hope that during your spring cleaning process you take some time to clean up your finances. Just as with your home, a couple of hours of dedicated work on your personal finances can go along way. Although I wouldn’t wait a year to revisit it; a monthly check-in would be much better.

Here are some things you should consider for your financial spring cleaning:

Organize Your Documents

If you’re like most people, you probably don’t even know all of the financial accounts that you have. You have a stack of statements but haven’t opened half of them because you don’t want to take the time to understand what’s inside.

Developing a process to organize your financial documents can make your life easier and help you become more aware of your personal finances. You can use a folder structure on your computer or in a cloud storage system, or even use a physical filing cabinet. Some documents that you may want to consider having in your organizer include the following: tax returns, life insurance policies, other insurance policies, estate planning documents, end of year account statements.

Get rid of what you don’t need. You probably don’t need every single account statement you have ever received. If you want something to compare to, then just keep the end of year statements. You also don’t need all of those informational documents that you’ve received and continue to hold onto.

Organize Your Account Logins

Even if you don’t want to login and look at your account, it still may be worth setting up login information so that someone doesn’t fraudulently do it for you. If you already have all of your login information for all of your accounts, then now might be a good time to update the passwords – especially if multiple accounts use the same password.

Make sure that you store your login information in a secure place. (That sheet on computer paper on your desk isn’t cutting it.) It may be wise to let someone who you trust know where the information is stored and how to access it if something were to happen to you.

Update Beneficiaries

While you’re updating your login information, you should check and make sure that the beneficiaries on your financial accounts and life insurance policies are up-to-date. This will relieve a lot of stress and heartache for your loved ones if something were to happen to you.

Net Worth

Now that you’ve got all of your financial information organized you can create a net worth statement that will help you get a better understanding of your current financial situation as well as help you to track your progress each month.

Budget

Tell your money what you want it to do for you. I want you to change your mindset about budgeting – you shouldn’t see it as the dreaded “b” word. A budget is a way to make sure that your money is working for you how you want it to and helping you reach your goals.

Wile you’re doing this you can make a list of all of the subscription-based services that you pay for each month automatically without you having to actually make a payment. Out of sight, out of mind – sometimes people pay for services that they never actually use but they keep paying for them because it’s easier than canceling. Get rid of those subscriptions that you don’t really need and use that money for something that’s more important to you.

Increase Your Retirement Savings

Even increasing your savings by 1% each year can make a significant impact over the long run. You’ll probably not even notice a change this small in your take-home pay.

Increase High Interest Rate Debt Payments

If you have high interest rate debt such as credit card balances now may be a good time to increase your monthly payments so that you’re not continuing to pay steep interest charges into the considerable future.

Shop Around

When’s the last time you checked to see if you’re paying too much for insurance? You may be able to save money on your homeowner’s and auto policies by using an independent insurance agent who is able to provide you with quotes from multiple different insurance companies rather than using an agent who works for a big name company where they’re only able to provide quotes from the company that they work for.

Credit Report

Now is a good time to pull a free credit report from one of the three credit reporting bureaus and make sure that nothing looks out of place.

Set Goals

Set goals for what you want your money to do for you the rest of 2019: travel, save X amount, increase your net worth by X amount, save for a down payment, buy a new car, etc. No matter what your goals are, make sure that you write them down and put a date on them so that you’re more likely to reach them. This includes setting frequent check-ins to evaluate your progress.

Financial spring cleaning can be a great exercise to help you get on track, evaluate where you are, and create a clear path forward for what you want your financial resources to accomplish for you.