By renting rather than owning. Let me show you.

The Potential Hidden Cost of Student Loan Forgiveness

While most of us are stuck with paying for our student loans, there are programs in place to help certain professions with their loads of debt. Public Service Loan Forgiveness (PSLF) as well as qualifying income-driven repayment plans can provide some with relief. But, there can be a catch…

Find Your Group

This post isn’t necessarily a post about financial planning, but it explains my experience from spending 3 days with a bunch of financial planners. As I mentioned earlier this week, I was in Chicago from Sunday afternoon through Wednesday afternoon for the NAPFA Summer Leadership Meeting. I was fortunate enough to meet with many successful fee-only financial planners who are passionate about NAPFA’s mission as well as NAPFA Genesis’ mission.

NAPFA Summer Leadership Meeting

I’ll be in Chicago through Wednesday of this week for the National Association of Personal Financial Advisors (NAPFA) Summer Leadership Meeting. Last month, I was extended an offer to serve as the Social Media Coordinator for the NAPFA Genesis Committee for the 2018-2019 fiscal year. The Leadership Meeting consists of reviewing strategic framework and performance, team building and leadership skill development, and outlining our priorities for the upcoming fiscal year. I feel as if this is a great opportunity for me to give back to my profession by helping other NAPFA members and doing my part to further the fee-only financial planning profession.

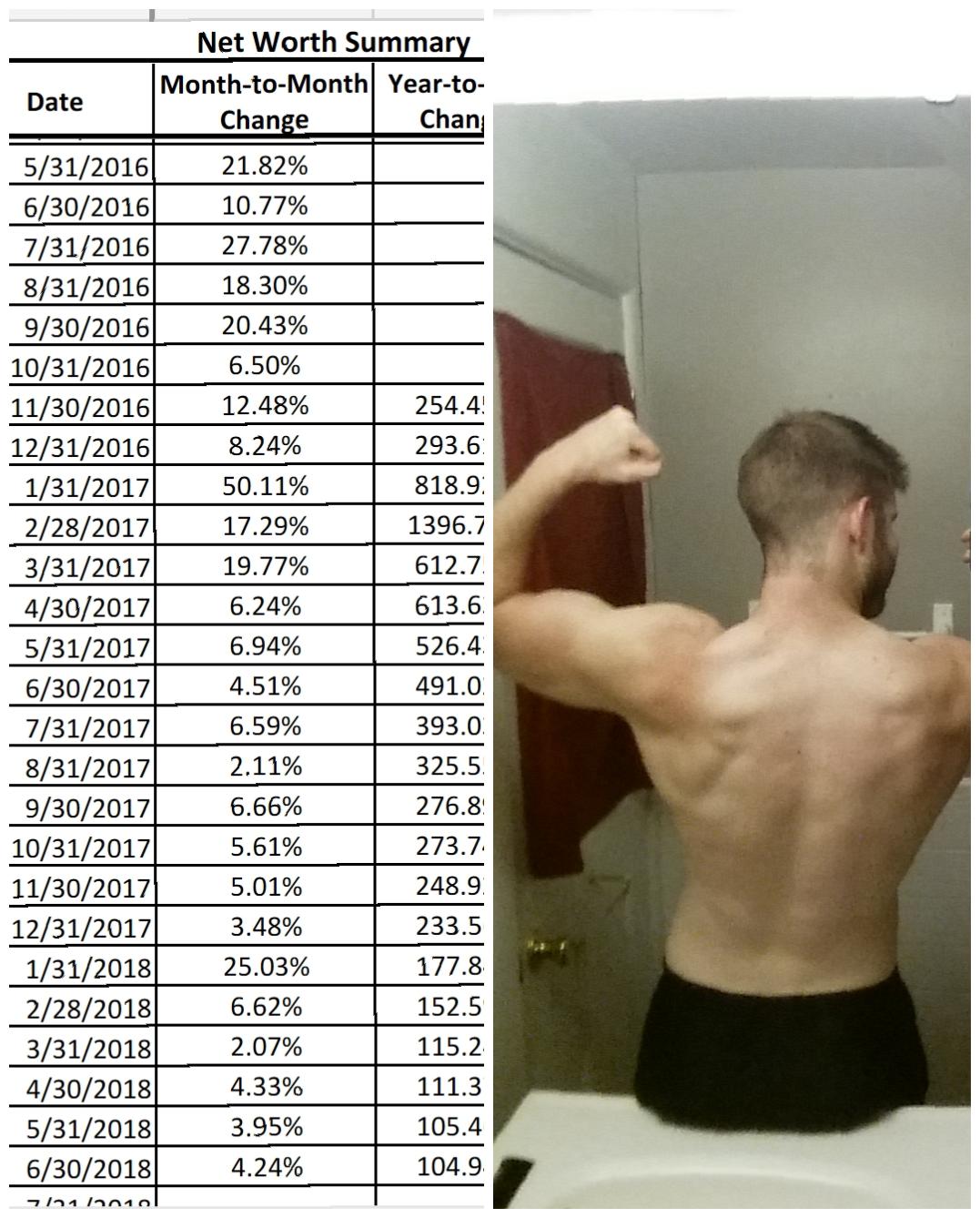

2018 Semi-Annual Goal Check-In

July 13 is a date that I like to reflect on my progress towards my goals because it was the first day that I got back into the gym in 2015 after some extended time off during my senior year of college. It’s not only a time for me to reflect on my fitness goals, but it’s also a time for me to reflect on my financial goals for the year and determine if there’s anything that I need to change going forward to reach them.

Playing the Lottery to Get Rich

Last week, someone told me that they saw one of those billboards which shows how much the Powerball is worth and said that they had to stop and buy a ticket after seeing the amount they could win. Sadly, many believe that their only path to financial freedom is through winning the lottery (although the person who said this to me was not one of these people). However, they never stop to think what else they could do, that’s realistic, to set themselves up for a better future. Surely, they know the odds of the lottery are stacked against them (1 in 200-something million means you’re probably not going to win). After all, there wouldn’t be a lottery if there weren’t more losers than winners.

Do You Know Where Your Money Goes?

I challenged myself in June to limit myself on unnecessary spending. This included things such as eating out, buying stuff that I don’t really need, and limiting entertainment expenses by utilizing things that I already have available to me. But, I wasn’t too strict on myself and I feel like I could have definitely done better.

If You Received a Large Sum of Cash Today, What Would You Do with It?

The term “a large sum of cash” has a different meaning to everyone. To me, $500 would be a large sum of cash, but to others who are wealthier than me this may not seem like something to get excited about. Maybe a better question would be, “If you were handed a meaningful sum of cash today, what would you do with it?”

Digital Asset Planning

Death isn’t something that we want to think about often. But, sometimes it’s something that is important for us to consider. You probably came across this post through some form of social media whether that be Facebook, Instagram, LinkedIn, or Twitter. Have you ever thought about what would happen to these accounts when you pass away? Who would have control over them? Who would be able to login to your phone or computer to retrieve usernames and passwords?

To Roth or Not to Roth

We all know by now that we need to start saving for retirement early. However, that funny word comes up every now and again that we don’t quite understand: Roth. More employers continue to add Roth options to their 401(k) plans and, depending on your situation, taking advantage of the Roth option could provide a great benefit to you in the future.