As I started writing my last post on whether or not you should buy a home, I thought it would be cool to ask my friends Austin and Jackie to “guest write” about an experience that they’re currently going through of buying their first home. I knew that they are people who have done the right things to successfully position themselves financially to make their first home purchase. I also knew that they are people who have thought through all aspects of buying a home rather than continuing to rent, instead of just buying a home because someone told them it’s what they should do. I don’t want to put too many words in Austin’s and Jackie’s mouths, so here’s what they had to say…

Home

Should I Buy A Home?

7 minute read

I’m a skeptical person and I prefer to research and make decisions for myself rather than do what society tells me I should do. When it comes to purchasing a home and “living the American dream”, I believe that too many allow society to dictate their actions rather than actually taking the time to think through such a significant decision themselves. I prefer to let research and math dictate most of my financial decisions, but this is a subject that most people have a hard time letting go of their emotions to think through.

Most people who own their home love it and the lifestyle that it provides and they simply cannot fathom that owning a home may not be the most financially optimal thing that they could do with their money due to that emotional attachment. Below, you’ll find some of the research that I’ve found both for and against owning a home.

Lifestyle Decision Vs Financial Decision

Buying a home is usually more of a lifestyle decision than a positive financial decision, when you consider all factors involved and the alternatives available to you. There are a lot more factors to consider when evaluating the decision that most people don’t take into consideration, but my research shows me that purchasing a home is not the most optimal thing that I can do with my money in my situation.

However, most people probably wouldn’t take advantage of what’s most optimal anyways and would rather opt for something they feel more comfortable with. I’m not saying that I’ll never buy a home, I will at some point, but I’m trying to do what is the most optimal for my money right now so that I’ll have greater financial flexibility in the future.

Why Buying A Home May Not Be The Best Financial Decision

I wrote about this last year and received a lot of feedback from people trying to tell me that I was wrong. However, most of those people weren’t considering all of the points that I’ve researched and none provided any numerical data to back up their claims. On the other hand, I also received quite a bit of feedback from those who own homes and agreed with the facts that I presented and my point of view but were not willing to rent due to the lifestyle that owning a home provides them.

“You’re throwing money away by renting.”

Alright, maybe I am. But you’re throwing money away by paying closing costs, interest, PMI if you have it, homeowner’s insurance, property taxes, HOA fees, and maintenance and repairs on a home. That’s all money that you’re paying just so that you can make some principal payments towards your mortgage.

Simply comparing the cost of rent to the cost of a mortgage isn’t accurate – you don’t have these additional expenses listed above when renting. Depending on your interest rate, the majority of your mortgage payment may be going towards paying interest for over half of the life of the loan before you ever turn the corner to where the majority of your payment is going towards paying down your principal balance. That’s a lot of money to be “throwing away” that’s not going towards making your personal finances better.

Don’t underestimate home maintenance and repairs. You never know when unexpected expenses will come up that you have to pay for when owning a home – bursting water pipes, a new roof, new water heater, HVAC repairs or replacement, replacing appliances, flooding, termites, mold, renovations, upgrades, routine maintenance etc. It all adds up and may not be as predictable as you’d like to think. If you’re not properly insured some of these could be huge out-of-pocket expenses. Even if you do have the perfect insurance in place, most of these things won’t be covered.

You may say that you’ll build equity by owning a home, but that may not be the best argument given the amount of time that most people own a home. Most people don’t stay in the home for very long and each time you move you have to pay realtor fees to sell your home, closing costs to purchase your new home, and potentially moving fees. Then, you’re going to be starting back over at the beginning of a mortgage where most of your payments are going towards interest.

Additionally, you’re going to be more likely to want to continue to make improvements to your home, especially as your income increases. Some improvements can be very costly while not actually increasing the value of your home. That could be money that you spend and never see again.

“But I can pay more on my mortgage”

True, you can, but the question of whether you should do so or not depends on the interest rate on your mortgage and your expected rate of return by investing that extra money instead. Would you be better off by investing your money at a compounded rate in the market or paying extra towards your mortgage at an amortized rate? As with most things in personal finance, the answer depends and could be different depending on whether you want to take the mathematically optimal approach, the emotionally optimal approach for you, or a hybrid.

“But home prices appreciate.”

Do you know how much home prices appreciate? Historically, in the United States, home prices have appreciated at about the same rate as inflation. In real terms (home price appreciation % minus inflation %), this means that you haven’t made any money through the appreciation of your home. Keep in mind, regional date could be much different and there are places where home appreciation has outpaced inflation.

Even if your home price has outpaced inflation, it doesn’t really do you much good unless you sell your home and get the money out of it or you pay to refinance/pull the equity out of your home. If you’re refinancing to use the equity out of your home, then you’re going to be paying interest again to use that money.

If you took all of those extra expenses that you’d otherwise have to spend to own a home and invested them in the market, which has significantly outperformed the appreciation of home prices historically, then history tells you that you’d end up ahead. The problem with this is that most people aren’t disciplined enough to “invest the rest”.

Depending on how much you plan to use as a down payment on the home, you could be losing out on quite a bit of returns by having that money in cash until you have reach a significant down payment rather than investing it in the market. Even if you were to calculate the rate of appreciation on your home, you’d still need to back out ALL of the money that you’ve put into it, including ongoing repairs and maintenance, to get to an accurate number of how much it has appreciated on a % basis.

“I own my home outright.”

If you’ve been diligent enough to pay off your home and you can say that you own it outright, that’s amazing! You’re in the minority. But, take a minute to think about what that does for you financially. As I mentioned above, in order to have access to the equity in your home you have to either sell it and incur the transaction costs of doing so or you have to use a financial instrument such as a home equity line of credit or a reverse mortgage to have access to that wealth. With a home equity line of credit or a reverse mortgage you’re going to be limited to the amount of equity that the financial institution will allow you to use.

You Aren’t Prepared

Most people don’t have a properly funded emergency fund in place or a significant down payment to put down on a home purchase. You want to have a cash reserve of 3-6 months of expenses in addition to a down payment before considering purchasing a home. You also want to make sure that you’re purchasing a home that you can actually afford and that you’re ready for the extra responsibility and potential unforeseen expenses that come along with homeownership.

Concentration Risk

As a financial planner, I’m expected to preach diversification to my clients. If someone has all of their money in one stock and something happens to the company, there’s the potential for the client to lose all of their wealth. Many people are in a similar situation with their home in that it holds the majority of their wealth.

If a home is not properly insured, or a homeowner doesn’t have a cash reserve in place, a disaster could mean a total, or near total, loss of wealth. Yes, the value of the land will still be there, but the home price for most people is probably worth more than the land alone. Many people live in a situation where their hopes for a positive financial future would be gone if their home were destroyed. Even if your home weren’t destroyed, you probably only own a house in one place. If that place experienced a significant housing market decline, your net worth would significantly decline along with it. It’s important to diversify your net worth outside of your home.

The Argument For Buying A Home

There are arguments for buying a home, but I don’t believe that there are many financially viable arguments for doing so in most situations. (Notice I said “most”.) One such point that could be made is that most people wouldn’t follow the plan I’ve set out above of investing the money that they would otherwise have to pay towards additional expenses to own and maintain a home.

Forced Savings

Yes, paying a mortgage is almost like forced savings, but remember that the majority of your payment is likely going towards interest on a 30-year mortgage for quite a while. Additionally, when most of your net worth is tied up in the equity in your home you can’t use it without selling or using another financial instrument that is going to cost you money.

Emotional Investment

Buying a home is a much better emotional investment for most people than it is a financial investment, given the available alternatives. Some people love completing house projects, working in the yard, and maintaining a home and making improvements without having to ask permission. They enjoy being able to come home from work to a house that they love and that they don’t have to follow rules in set by a landlord. I believe that the emotional aspect of owning a home is the most viable argument and one that I would concede with much more readily than a financial argument for doing so.

First Time Home Buying Process

Not everyone is willing to live the renting lifestyle, even in a standalone home, and I understand that. Some people want a place that they can call their own and that they can personalize without having to answer to anyone else. I’ve asked one of my friends who has recently purchased a home to write a post about his experience of buying his first home. Be on the lookout for his article at the end of this week.

Additional home purchase consideration resources:

- Episode #100: Elroy Dimson, “High Valuations Don’t Necessarily Mean That We’re Going to See Asset Prices Collapse” – Meb Faber, Meb Faber Research Stock Market & Investing Blog

- I’m a financial planner — here’s why I won’t buy a home – Eric Roberge, Business Insider

- Why your home is a worse investment than you think – Ken Fisher, USA Today

- I hear you, but your home is still a lousy investment – Ken Fisher, USA Today

- Point/Counterpoint on Real Estate as an Investment Option – Ben Carlson, A Wealth of Common Sense

- The true cost of homeownership is higher than you think – Wealthy Nickel

- How Much House Equity Are You REALLY Building? – Eric Roberge, Beyond Your Hammock

The 3 Financial Tips Young Professionals Need

4 minute read

Keep The Big 3 In Check

The Big 3 are the 3 biggest expenses that most people have: housing, transportation, and food. Keeping these 3 costs in check will have a much more significant impact on your cash flow than skipping your morning coffee from a shop. Not only will being intentional about keeping these expenses low allow you more flexibility with your cash flow, but it will also allow you to maintain a higher savings rate (the next key we’ll speak about).

A rule of thumb that’s thrown around is that your monthly mortgage payment (including principal, interest, property taxes, and homeowner’s insurance) should be a maximum of 28% of gross income. However, many people fail to recognize this is a maximum. You’re probably already having a third of your income taken for various income taxes when considering FICA, Federal, state, and local taxes. If you’re spending nearly another third on your mortgage payment, then where are you going to get money to save, pay bills, or accomplish your goals?

Stretching your cash flow just to buy the house of your dreams probably isn’t a good idea. Adjusting your mindset and being willing to live in cheaper housing will provide much more financial flexibility in the long run. Once you’ve made a mortgage payment you can’t get it back unless you pay to take out the equity in your home.

Yes, we all want to drive a nice, brand new car, but is it worth sacrificing other goals over? New vehicles are expensive and transportation costs count towards a large part of many people’s cash flow. The point of having a car is to get from point A to point B and a cheaper, but still reliable car, does the exact same job as an expensive one – just not in as much style.

If cars are your thing and you’re willing to make significant sacrifices in other areas of your life to make sure that you’re able to reach your goals, then that’s fine. However, since experiences provide more happiness than things, I prefer to spend part of the money that I would on an expensive car on experiences that I’ll value for much longer and save part of it to help me reach financial independence. Cheap transportation still gets you to where you need to go and provides financial flexibility while doing so.

Cooking at home can be very time consuming, but it can also save a lot of money. The convenience of eating out is relatively expensive compared to buying groceries and cooking at home and can be much more calorically dense. Just consider the amount of meals that you can prepare with the $50 you might spend at a decent restaurant on a date night. Eating out doesn’t need to be cut out of young professionals’ budgets completely, especially if trying new foods and restaurants is something that really makes you happy, but it shouldn’t happen as often as you preparing your own meals. Cutting back on eating out can provide significant savings if it’s something that you do often.

Maintain A High Savings Rate

Starting out with a high savings rate is extremely beneficial to young professionals because of the significant amount of time that we have to invest the money. Additionally, saving a large percentage of your income can help to mitigate too much lifestyle creep and it can provide flexibility in the future when life happens and you’re not able to save as much as you need to.

Maintaining a high savings rate doesn’t mean that you have to save as much as possible or even have a high savings rate every single paycheck, month, or year. There will likely be periods of higher savings and lower savings – what’s important is that your savings rate remains high over time. Most young professionals won’t have pensions available to them and the future of Social Security for younger generations isn’t certain; it’s up to us to be responsible and create successful financial futures for ourselves by saving now.

Develop Good Financial Decision-Making Skills

Keeping The Big 3 in check and maintaining a proper savings rate are great financial habits, but what happens when something pops up that you weren’t necessarily ready for? It could be a financial emergency or a financial opportunity, but either way you need to be prepared to make the right decision for any situation. Having goals clearly stated for what you want your money to do for you can help with this.

How will you react when your car breaks down and can’t be fixed? Will you buy a brand new one that you’ll need to move on from in a few years because it isn’t practical long-term, buy a new car that you know you’ll be able to drive (and enjoy) for the next 10 years, or will you buy a cheaper, used vehicle that still has significant life left in it?

What about if you’re presented with a financial opportunity to help start a business or purchase a home for below market value? It’s important to revisit your goals and see if these decisions fit into them. Even if you’re able to buy it below market value, you probably wouldn’t buy a home if your goal is to find a job in a different city in the next 6 months.

Keeping The Big 3 in check, maintaining a high savings rate, and developing good financial decision making skills can all be invaluable to young professionals in the long run. These skills will not only allow you to develop a solid financial foundation now, but will likely carry with you throughout your life to help you to be financially successful. Money is a tool that we can use wisely to help us reach our goals or something that we can waste away without being intentional with it – I think that making sure it helps us reach our goals is a much better option.

How I Save Over $7,000 Per Year

4 minute read

People keep asking me when I’m going to buy a home (they must not read this blog), so I wanted to dig more deeply into the numbers to see just how much I save each year by renting rather than owning.

There’s plenty of evidence that shows that a house isn’t a very good monetary investment, although the common misconception is that it is. I’ll show this in a minute.

However, a home can be a good “investment” in your family and lifestyle (notice I didn’t say for your money). It provides a place that feels stable, comfortable, and safe. For the most part, you can do what you want with and make it yours (subject to HOA rules and other laws). Some people see it as sort of a right of passage and it’s “weird” when an older person or a couple with kids rents rather than owns. In some places, there isn’t a renting market available which kind of forces buying a home.

I’ve written about this before here and here, but I’m going to go more in-depth to show how much I actually SAVE by renting rather than owning. A lot of people probably already think I’m an idiot for even saying that I can save money by renting because, “You’re throwing away money by paying rent.” That’s because those people aren’t comparing the costs correctly.

Costs of Owning in My Zip Code

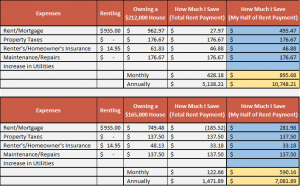

Let’s see what we need to consider to actually compare ALL the costs. We’ll use the table below to compare the rent of my apartment ($935 per month) to the median home price of $212,000 in my zip code (according to Zillow). However, that wouldn’t necessarily be an accurate comparison since I only pay half of the rent ($467.50 per month) and half of the utilities.

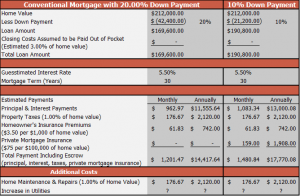

Below, we can see how much it would cost to own a median-priced home where I live. It’s much more expensive than my rent, although the home would probably be larger than my apartment:

Also, consider the costs that I haven’t factored into this scenario: coming up with the cash for a down payment as well as 2-5% of home value for closing costs, moving expenses, furniture and decorations, appliances, increased utility expenses for owning a home.

Costs of Owning a Home with a Mortgage Payment Equal to My Apartment’s Rent

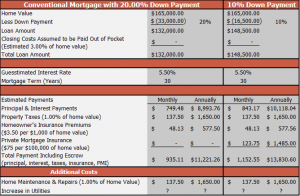

Don’t think I should compare to the median home price in my area? That’s fine. I also figured out how much I could buy a home for to make the full mortgage payment, including escrow, equal to the total rent payment of my apartment. I still come out ahead in this scenario because I don’t have maintenance costs as a renter and only pay half of the utility bills:

After 10 years under the 20% down payment scenario, you’ve made $89,937.60 in principal and interest payments and only have $23,045.68 in equity. This doesn’t even consider the costs of property taxes, homeowner’s insurance, and maintenance, which would add an estimated additional $38,775 to what you’ve spent over those 10 years. I still haven’t factored in the increased costs of paying for utilities for a home, which would likely be more expensive than an apartment.

Comparison of Renting vs Owning

An easier way to look at this is below where I’ve shown how much I save compared to owning a $212,000 home (median home value) and compared to owning a $165,000 home versus the rent of my apartment. Since I only pay half of the rent, I’ve also compared how much I actually save (see the yellow highlighted boxes). Even if I paid the full rent each month, I’d still be ahead by renting in all presented scenarios:

Notice that these comparisons assume that the home was bought using a 20% down payment. The lower the down payment used, the more that renting is favored due to the higher mortgage payment and PMI for a down payment below 20%.

When I’ll Buy a Home

I don’t know when I’ll buy a home. For now, I’m fine with renting and being able to save for my future and have flexibility. I can email my property manager every time something goes wrong and she gets it taken care of immediately. I don’t have to do yard work or any sort of maintenance. I don’t have to worry about my home being destroyed and having to repair it or rebuild it – I’d just find another apartment. If I wanted to, I could move every year and experience living in different places until I’ve found where I’d really like to be for the long-term. But I get it; renting isn’t for everyone.

Don’t get me wrong, I’ll eventually buy a home for my family. Overall, I hope we now realize that the value of owning a home typically isn’t monetary; it’s knowing that your family has a safe place with a roof over their head where they can make memories and experience an environment of “home”.