Some people still think of fees charged by financial advisors in terms of investment management fees. That’s fine if your advisor is only providing investment management, but many financial planners (such as myself) provide comprehensive financial planning, in addition to investment management, which provides much more value than just investment management.

I work for a firm that charges clients a fee as a percentage of the investable assets that we manage for them (we charge this way to eliminate conflicts of interest that come with earning commissions). However, the financial planning that we provide for clients is where the real value is. It’s easy for me to see why people still see the fee in terms of investment management, rather than the value that they receive from financial planning, since they are charged a fee as a percentage of their assets that our firm manages.

Earn Your Fees

Sometimes, it’s difficult to communicate to potential clients the value of our financial planning services. No matter how the value is portrayed from our end, some people still have the notion that we have to earn enough excess return above the market to pay for our fees.

Do you do your job for free?

What other profession is expected to provide you a service and pay for it themselves? It’s not necessarily wrong to think that an advisor should earn you a return above the market return (although it’s not necessarily likely, either), but it shows that they’re not considering the value of all the financial planning that we would do for them in addition to the investment management that we’d provide for them.

People will purchase expensive houses and cars, buy the newest tech gadgets every year, and go out to eat every night, but are hesitant to invest in their future because they have a hard time getting past the fees of financial planning. You can see the prices of financial planning listed on websites, but you can’t necessarily see the value. The value is on an individual basis and that’s up to the consumer to determine.

How much time and money have you spent on stuff that didn’t really make your life that much better and you still don’t know if you’ll be able to reach your financial goals or if you’re doing everything you need to be doing to provide the life that you envision for yourself and/or your family?

Is anything going to change if you continue on the path that you’re on?

Value of Financial Planning

What would it mean to you if you could invest in yourself and your financial future and find more concrete answers to all of your financial questions based on your personal situation? Peace of mind? Less stress? Less worrying about your future?

Sometimes “costs” need to be looked at through a “value” lens, instead.

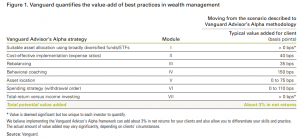

Putting a monetary value on financial planning services would be difficult, but is something that Vanguard has done since 2001 through their annual Vanguard Advisor’s Alpha whitepaper. In 2016, Vanguard published a whitepaper named Putting a value on your value: Quantifying Vanguard Advisor’s Alpha which concluded that advisors who use the strategies outlined in the original whitepaper (Market Street is a firm which utilizes these strategies) can provide alpha (otherwise known as additional value) of about 3% in net returns. Obviously, this isn’t a tried and true number, but an estimate, as it varies from situation to situation.

How’s that for excess returns that pay for your fee?

Financial Planning vs Investment Management

One of the most interesting things to me is that Vanguard estimates that advisors add about 1.50% of value through behavioral coaching and 1.10% of value through spending strategy (withdrawal order during retirement). Compare this to Vanguard’s estimated typical value added for clients through investment activities: suitable asset allocation at 0%, cost-effective implementation (expense ratios) at 0.40%, rebalancing at 0.35%, and asset allocation at 0.75% for a total of 1.50%.

According to Vanguard, the majority of the value of a financial planner is the advice that they provide and keeping clients from making irrational decisions, not from the investment activities that they help you with. Although, 1.50% value added through investment management isn’t too shabby.

However, many of those people who are concerned with fees fail to recognize this value. On the other hand, financial planners probably don’t do a good enough job at tracking these values and portraying them to clients and prospects on a regular basis.

What’s the value of:

- Knowing how much you need to save to retire when you want to?

- Knowing when you can retire based on your current assets and savings rate?

- Knowing how much you can spend in retirement based on your situation?

- A tax-efficient withdrawal strategy during retirement?

- Tax planning strategies that help to become much more tax-efficient which saves you taxes? (Hint: It’s probably the amount of taxes you didn’t have to pay)

- Knowing that you have all of the proper insurance coverages in place with all of the correct terms and conditions (health, life, disability, home, auto, long-term care, etc.)?

- How much more valuable is it if a planner finds that you have an unfavorable disability insurance policy with less-than-adequate coverage and an unfavorable definition of disability and you ended up having to use the policy?

- Being coached through the business cycle and market noise as you see your portfolio value fluctuate? (Vanguard estimates the value at 1.50%, which more than likely pays for your fee)

- Remember in January 2016 when the Royal Bank of Scotland told everyone to sell everything? A good financial planner would have told clients to hold tight and those clients have been rewarded with 49.74% US equity gains since the time of that article on January 11, 2016 (this isn’t a perfect example since clients likely aren’t 100% in the S&P, but just an example).

- Maximizing your employee benefits?

- Developing a strategy for the equity compensation (stock options, restricted stock units, etc.) you receive through your employment?

- Developing a plan to save and pay for your children’s college educations?

- Creating a savings and debt paydown strategy?

- Helping with a home purchase decision?

- Helping create and monitor a budget?

- Maximizing Social Security?

- Analyzing pension options?

- Analyzing and determining charitable giving strategies?

- Estate planning document review and analyzing and making sure that beneficiaries are updated and correct on all financial accounts?

- And more.

Are these all things that you can do on your own or that you want to pay the cheapest price possible for?

Price should be considered in relation to value.

You know what they say: You get what you pay for.