The goals that you want to achieve in life, which in turn drive your financial goals, are probably aligned with your values. For example, people who don’t value travel don’t have goals of traveling the world. People who value helping those who are less fortunate than them may have significant charitable contribution goals. However, sometimes what we say that we value, and in turn, what we say that our goals are is idealistic rather than realistic.

Budget

Reverse Budgeting

In January, Amanda and I bought airfare and started making plans for a 2-week trip to Italy in May to celebrate our 1-year anniversary a little early. That fell flat on its face. Instead, last week we went to Savannah to celebrate. We went on the trip without an itinerary, list of things to do, or a budget.

Day 24 Of 30 Days Of Stay-At-Home Personal Finance Wins: Create a Budget/Spending Tracking System

What if you were able to come out of this time of social distancing and economic crisis with a stronger and healthier financial life? What if you looked at this as an opportunity to take a little bit of your extra time each day to work on your finances?

The Coronavirus And Your Money

Every day, something new comes out about COVID-19 and how it’s impacting our society. We’ve seen the financial markets experience a lot of volatility over the past couple of weeks (and it looks like there’s probably more to come), which can be scary and nerve-racking for a lot of people. It’s completely normal to feel that way given all of the news around these events and all of the different points of view we may hear. I’m sure that things will probably get scarier with more people testing positive for the coronavirus and more things shutting down to try and mitigate the spread.

How to Stick to Your Budget In 2020

As I’m sure you can already guess, one of the most common New Year’s Resolutions is to stick to a budget. This is a terrible goal.

Do I REALLY Need A Budget?

4 minute read

At my job, I come across a lot of people who want to retire but have no idea how much money they need to live on. Not even a ballpark idea. They’ve just lived their life spending and saving without really knowing how much they do of either. I think that most people can adjust to the amount of money that they have available to spend, but sometimes what I estimate they’re spending now and what they’re going to be able to spend in retirement are miles apart. This could be a huge shock when it comes time for them to adjust their lifestyle and start living on much less.

This is one reason why I think it’s important to budget.

Budgeting for Singles

Over the past couple of years, I haven’t been as good at maintaining a budget and tracking my expenses as I would have liked to. It’s hard. It’s time consuming. It’s not the most fun thing to do. Sometimes it can feel too restrictive. Trust me, I get it.

When you’re single, I think that you can get away without having a budget, if you’re frugal and spend wisely. Unfortunately, most young, single people don’t fall into that category. Over the past couple of years, I haven’t used a very strict budget and I was able to save 27% of my income in 2017 and 25% in 2018. I just lived by the principles of frugality and spending wisely. So, I do think that there are people who can get by without budgeting and will be fine in the long-run, but I don’t think there are too many people who are as big of natural savers as I am.

Would I have been able to save more if I had used a budget and been stricter? Absolutely. But personal finance is a balance between living for today and saving for the future. I feel like I’ve done a pretty good job doing both.

Budgeting for Couples

I do think it becomes much more important to use a budget and track spending when there are multiple people involved. There are so many more things going on when there are two people and probably twice the amount of transactions to keep track of. This is especially important if you have separate bank accounts or separate credit cards that you use – it’s good to have all of that information in one place.

A “couple’s budget” not only allows you to have a good idea of where your money goes and who needs money to spend on what each month, but it can also help to keep each other accountable and make decisions as a team about what you want your money to do for you and where it should be allocated.

For those who are married, in a serious relationship where your income is viewed as joint, or who are engaged and will be combining incomes soon, I urge you to sit down and write out a budget. No, it’s not the most fun thing to do, but it will pay off immensely over the long-run. We always hear that money is one of the biggest reasons for divorce in America. Why wouldn’t you be proactive about making sure that doesn’t happen?

Progress, Not Perfect

If you’re not doing any sort of budgeting or expense tracking, then you don’t need to immediately go all in. Whatever you do doesn’t have to be perfect, just do something to make progress. Start with some easy steps and progress from there.

You could start by just keeping track of your spending for a month, evaluate where you felt you spent too much, and then work on it the next month. From there, you could implement a simple budget like the 53/30/20 rule where your after-tax income is allocated 50% to be spent on needs, 30% to be spent on wants, and 20% to be saved. Beyond that, you can use tools such as EveryDollar, Tiller Money, or YNAB. Making things more difficult usually isn’t the right answer because it’s intimidating and mentally fatiguing.

You’re gonna suck at it at first, it’s not going to be easy, and you’ll probably blow completely through what you thought was a realistic spending plan and not meet your savings goals. Don’t let that deter you. Use it as a tool to see where your money goes, evaluate if that’s where you really want it to go and if that’s what really makes you happy, and assess if your current spending is helping you reach your goals.

There are so many things that you want to accomplish and a lot of them probably require money. It’s your choice – you can be intentional and proactive with your resources to make sure that you reach your goals, or you can live life and hope that everything works out.

A little bit of discipline can go a long way.

A Smarter Way To Give

3 minute read

The holidays are a time of giving and spreading joy, but that doesn’t mean you should let making others happy derail your progress and set you back from reaching your goals. There’s nothing wrong with spending money on gifts that you think will others happy, but there’s a better way to go about doing so than waiting until the holidays and hoping that your bank account can withstand the onslaught.

Here are a few tips to help you make a plan to spread joy in 2019 without sacrificing your goals along the way:

How Much Will You Spend?

Don’t just consider how much you’ll probably end up spending during the holidays (what you spend this year is a good place to start), but also take into consideration other gifts that you’ll likely purchase throughout the year such as birthday presents and wedding gifts.

How much did you spend on Christmas this year? Did you wish you were able to buy more? Was it too much? Will you spend the same amount next year?

Who do you want to give birthday gifts to and how much do you want to spend on them? Do you know anyone who is getting married next year who you’d like to give something to?

There are quite a few gift giving opportunities throughout the year to take into consideration, including some that I haven’t mentioned. Once you’ve tallied up how much you think you’ll spend on gifts in 2019, you’ll be able to come up with a better idea of how much you should be setting aside each month to make sure that you can meet your goal and give everything that you’d like to.

Create A Savings Plan

Make sure that you’re saving enough each month that when the time comes to purchase a gift you don’t have to cut back in some other area to account for it. You could setup a separate savings account for this money and name it something along the lines of “gift fund” or you could simply save it to your personal savings account and just know that it’s there for a specific purpose.

If you start in January and remain diligent throughout the year, then your budget (or savings meant for other goals) shouldn’t be impacted when the time comes to make a purchase. If you don’t want to have to save all year for Christmas, and you’ll be able to pay for any birthday presents or wedding gifts throughout the year from your budget, then you could begin saving for Christmas in July to give you plenty of time to make sure that you’ll be ready.

Spend!

You did everything right – you made an estimate of how much you’d spend on gifts throughout the year and you saved a little each month so that you knew the money would be there when the time came. Now it’s time to by the gifts!

If you’ve set up a separate account for this money, then it will be easy to keep track of where you’re at when you start spending. When you’ve spent all the money that you’ve saved, then it’s time to quit. You can feel proud that you were able to buy things for your loved ones without sacrificing your personal financial goals.

Enjoy Giving

The whole reason that you went through the trouble to consider how much you might spend on gifts next year, create a savings plan, and pick out the presents is to make others happy, right? But, you get something out of it, too. Giving gifts to others and seeing them happy provides us with joy as well. Take some time to appreciate the happiness of those who you gave something to and be proud that you were able to do so through wise financial planning.

Saving for gifts throughout the year probably isn’t something that most people consider in January when setting goals and creating a budget. Rather, most people probably think about paying for gifts when the time comes and find other ways to cut back in their budget to take care for them. Or worse, they purchase things on a credit card and run up a balance that they’re not able to pay in full when the payment comes due.

By making a plan now and preparing for the presents that you’re likely to purchase throughout 2019 (yes, even the Christmas gifts that are almost a year away), you can make things easier on yourself once the time comes knowing that the money is there for you to spend and that you don’t have to make any special adjustments to your budget that month to afford to buy someone something that you think will bring them joy.

Getting Back on Track

3 minute read

We don’t want to make it a habit to continue to do this and justify it as just a one-time thing that won’t have much of an impact over the long-term, because then it will become a habit and it will have an affect on reaching our goals. What we should is do not dwell on it and get back on track.

Another Holiday Mistake

Maybe you not only blew your diet out of the water over Thanksgiving, but you also blew through your budget. You didn’t plan on buying all of that stuff but then Black Friday deals and new and shiny and…Yeah, I get it. Unlike with what you ate, you can return the things that you bought and get your money back if you really don’t need or want them (hopefully, you don’t see that as an option for the food you ate, too).

However, if you could afford those things without affecting your progress towards your goals, and they’ll provide long-term value to you, then you can just keep them. There’s no need to worry or feel guilty about spending money that doesn’t negatively affect you reaching your goals because you’ve obviously budgeted to spend that money at some point.

Get back on track, follow your budget, and keep making progress towards your goals.

What you don’t want to do is to develop the “screw it” attitude and tell yourself that it’s okay to continue to buy things that you don’t really need or want because you’ve already screwed up. Well, I’ll just buy this one more thing that I really want. Oh, well, I really like that thing too and I already messed up my budget, so I might as well go ahead and buy it. The rabbit hole can be a tricky place to get out of.

Here are 3 tips to get back on track after overspending during the holidays:

Reevaluate Your Budget

Take some time to sit down and review your budget. Make any changes necessary to reflect your projected spending in December and create a plan for how you want your money to work for you. You could plan to spend less in the upcoming months to make up for your overspending this month, but how likely are you to stick to this once the time comes?

If you overspent significantly, then you may want to consider budgeting for these expenses beginning in January for next year. For example, if you think that you’ll end up spending $1,000 on Black Friday in 2019, then budget to save $91 per month from January through November.

Keep Your Eyes on the Prize

You’re going to see a ton of advertisements and “deals” in December. Don’t be tempted to go off budget and spend money on something that you haven’t budgeted for and don’t really need or want. If you needed it or wanted it that badly, then you would have included that within your December spending projections or, if it’s a big ticket item, you would have started saving for it a while ago.

The prize isn’t that new gadget that you see an ad for on TV and feel compelled to buy, the prize is knowing that you’re one step closer to reaching your goals and to financial freedom

Track Your Progress

Make a point to sit down each week and record your spending. Take note of how much you’ve spent in comparison to your projections and if you need to adjust to compensate for overspending or if you have some wiggle room to buy something that you haven’t planned on. Or, you could save any extra money and get a head start on your 2019 savings goals.

Proactively tracking your progress not only keeps you aware of where your money is going each week, but it can also serve as a weekly dose of motivation to make adjustments to make sure that you reach your goals.

Thanksgiving has come and gone – don’t worry too much about how many thousands of calories you ate that you maybe shouldn’t have or the money that you didn’t really plan to spend. Getting off track every once in a while doesn’t mean that you’ve ruined everything, but it also shouldn’t be used as an excuse to continue making the problem worse. Learn from the mistakes that you made, make them better if you can, and set a plan of action to help make sure that you don’t make those same mistakes again in the future.

Increase Your Net Worth By 7,307% In One Year? It Can Happen.

< 1 minute read

There wasn’t some miracle that had to happen to do this and she didn’t win the lottery. She didn’t buy some product that promises to take care of all of your financial woes and she didn’t start selling products from an MLM that promise to make you rich beyond your wildest dreams.

It’s simply a result of staying disciplined and executing a plan. There’s probably been much less discretionary spending on clothes, going out with friends, eating out, and hair appointments than she would like, but it has clearly paid off. She’s had to keep her long-term goals in mind to make sure that those old day-to-day spending habits wouldn’t derail her progress.

She used a simple formula that can work for anyone:

Live Below Your Means + Save + Invest + Focus on Paying Down Debt = Financial Success

She did start at a negative net worth last year (not anymore), and it’s likely that her net worth will go down over the coming years since she’s going back to college to finish her degree, but she’s buckled down and done what she can over the past year to put herself in a much better position to do so without completely wrecking her financial situation.

I’m proud of her for that.

Begin Planning Now for Summer Vacation

< 1 minute read

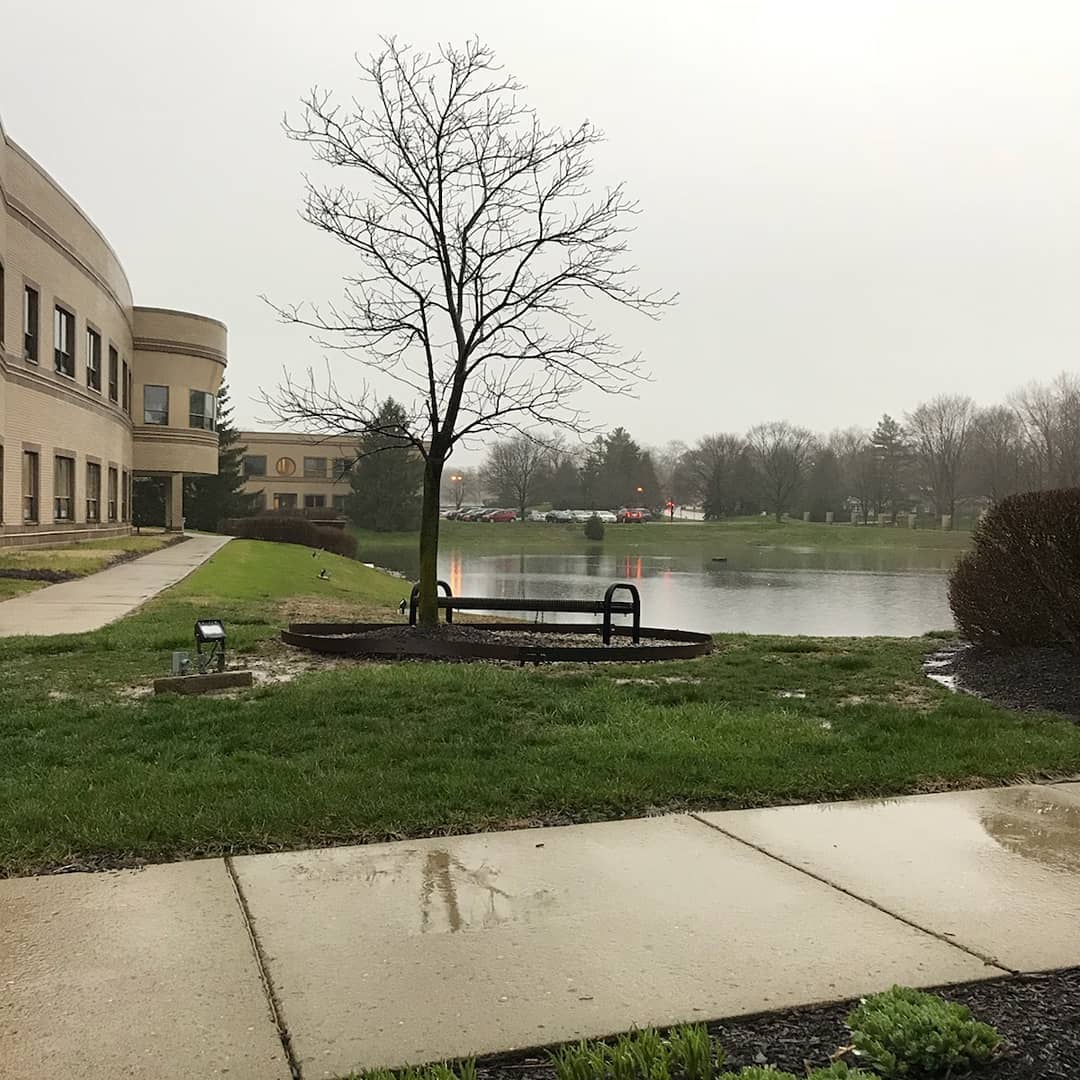

You’re probably already looking forward to summer and having your toes in the sand on a beach somewhere warm…and not rainy.

On a day like today when you just want to stay inside take the opportunity to start planning and saving for your vacation now so that when the time comes you don’t have to worry about paying for the trip or having to use a credit card for unforeseen expenses that you didn’t budget for.

You’ll also probably be able to find some good deals and free things to do by starting early and shopping around.