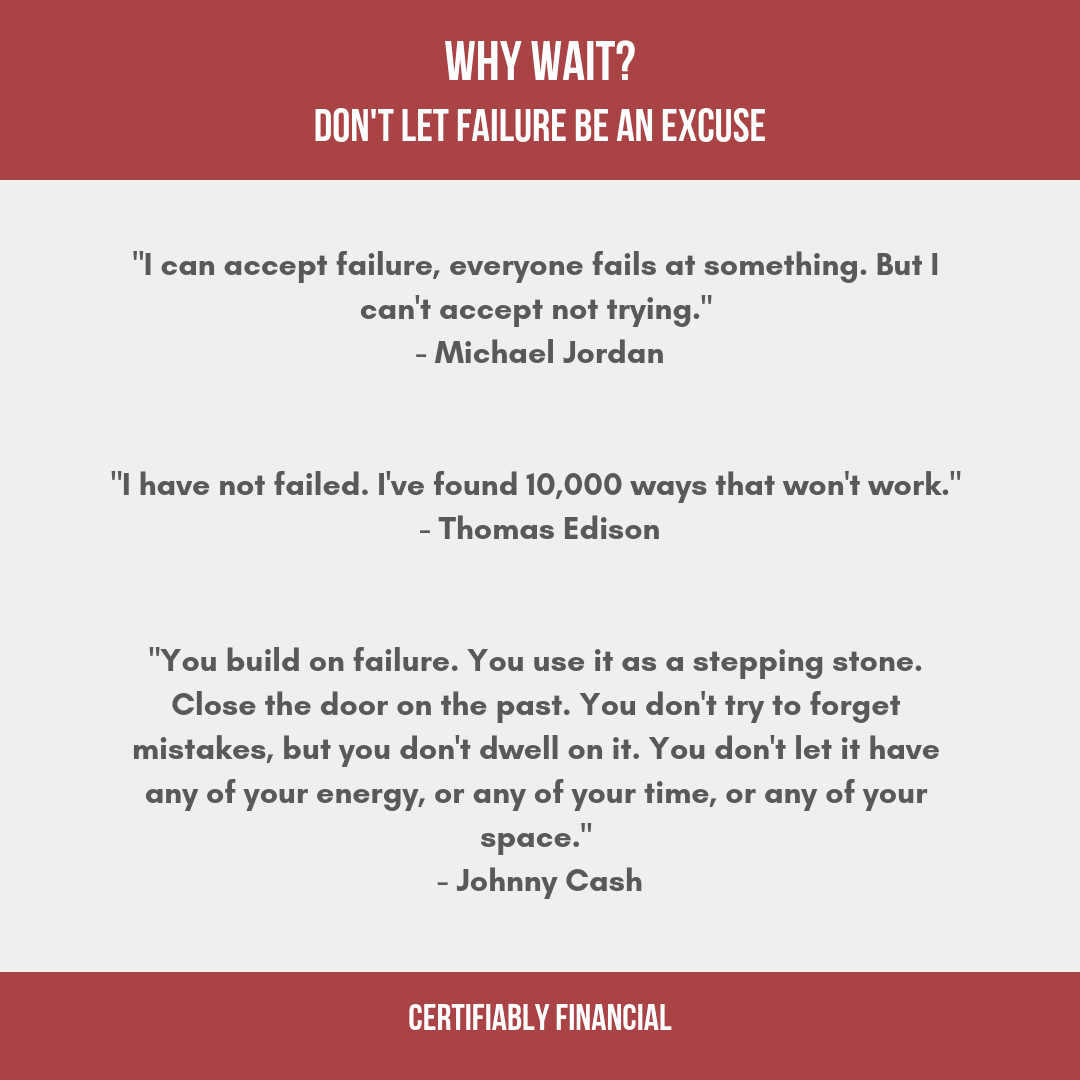

“I can accept failure, everyone fails at something. But I can’t accept not trying.” – Michael Jordan

Mindset

2018 NAPFA Fall Conference

I had the opportunity to spend the majority of this week in the City of Brotherly Love while attending the NAPFA Fall Conference.

Push Yourself

Earlier this week I was informed that I’ve been selected to the Young Professionals of Central Indiana (YPCI) Board of Directors for 2019. I made it a goal for myself to attend at least 2 networking events each month this year and YPCI is one of the organizations whose events I’ve been attending. I’ve really enjoyed my time at YPCI’s events and have made some great connections through them.

Three Ways to Travel Cheaply

My favorite stories that people tell me are about the strategies that they use to travel cheaply and the experiences that they’re able to enjoy by doing so. I love traveling but, as we all know, I don’t love spending money. However, I’m more apt to spend money on a trip than on most material things. Even so, I still don’t want to pay more than I have to. I’ve recently been able to speak with four people who frequently travel cheaply and I wanted to share a little bit about how they do so and what I’ve learned from them.

Binge Spending

A quick Google search tells me that I either may have just made that term up, or I have no idea what I’m talking about. Either way, I’m sticking with it. I’m not talking about Compulsive Buying Disorder (CBD), which is a mental health issue that can wreak havoc on your financial situation and that I’m not qualified to discuss. I’m talking about something that I’ve witnessed which is (hopefully) less impactful on your financial situation than CBD but could still have a negative effect.

Be A Doer

To me, there are “talkers” and there are “doers”. Usually people aren’t both. I like to think of myself as a doer (at least, I do my best to be a doer). Whenever I get an idea that I’m excited about and I think is worth acting on, I try to learn as much about it as possible within the shortest amount of time that I can and then execute it to the best of my abilities. It’s silly, but sometimes I actually get frustrated with people who I perceive as talkers – people who I hear continue to talk about things that they want to do rather than actually making them happen. This especially frustrates me when I feel like the thing they talk about doing could make their life much better, such as improving their financial situation or health, but they just won’t do it.

The Grass Is Always Greener

A handful of clients lately have been asking if we should become more aggressive in their portfolios and shift some of the allocation from bonds into stocks. If we think about this, we’d be doing exactly what we’re taught not to do: we’d sell the bonds at a low point and buy the stocks at a high point. Isn’t the old saying, “buy low, sell high”?

Spending Money Is Hard

This may sound like a stupid statement to some, but I’m sure there are plenty who emphasize as well. Sometimes I get so caught up in saving and working towards my financial goals that I feel guilty when I spend money, even when I’ve budgeted for it. This is hypocritical since I try to teach people to budget for things and then use that money to pay for them.

Playing the Lottery to Get Rich

Last week, someone told me that they saw one of those billboards which shows how much the Powerball is worth and said that they had to stop and buy a ticket after seeing the amount they could win. Sadly, many believe that their only path to financial freedom is through winning the lottery (although the person who said this to me was not one of these people). However, they never stop to think what else they could do, that’s realistic, to set themselves up for a better future. Surely, they know the odds of the lottery are stacked against them (1 in 200-something million means you’re probably not going to win). After all, there wouldn’t be a lottery if there weren’t more losers than winners.

What’s the Best Way to Pay Off Debt?

Some people absolutely hate the debt that they have and want to get rid of it as soon as possible. Some people (dangerously) have no clue how much debt they have and would rather pretend that it’s not there than to be proactive and do something about it. If you’re one of those people who want to get rid of your debt, then what’s the right way to go about doing so? Do you pay down the highest balance first or the debt with the highest interest rate first? Should you actually be paying down your debt more aggressively than required?